Chase MyHome Dashboard

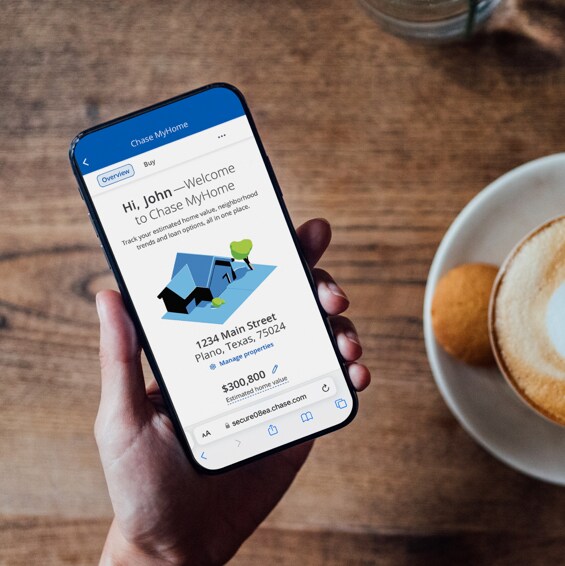

Chase MyHome®

Your home journey — simplified

All things home. All in one place.

The key to easier homeownership is right at your fingertips. Sign in above to start your journey.

Your go-to dashboard

Chase MyHome, can help you at every stage of homeownership — from seeing how much you can afford and searching for homes and loans, to managing your mortgage and understanding the value of your home.

Fully digital experience

Enjoy less paperwork and more ease. With Chase MyHome, you can complete applications, sign documents and follow your progress from your desktop or mobile device.

Personalized to you

Simply sign in with your Chase account to use Chase MyHome. Even if you don’t have a mortgage with us — if you’re a Chase customer, or new to Chase, you can still access home insights and resources.

Buy a home

Easily estimate payments and compare rates to choose your home loan.

Affordability calculator

Use our affordability calculator to find out how much you may be able to afford so you can feel confident during your home search.

Compare rates

See current purchase rates in your ZIP code. We update this information daily, so you always have the most current info on hand.

Choose your loan

See the mortgage options available to you, choose the one that fits your goals and apply when you're ready.

Search for properties

Chase MyHome helps you discover homes to match your lifestyle and keep up with market changes.

Browse homes

Quickly search by ZIP code, city or address to browse properties and see need-to-knows, like home value info, sale history and upcoming open houses.

Save your favorites

When you see a home you love, save it to your favorites and we’ll help you keep track so you can compare properties and see loan options for each one.

Grant eligible properties

Explore properties that qualify for our Chase Homebuyer Grant which provides $2,500 or $5,000 in select areas across the country. The grant is first applied to help lower your interest rate, then it can be applied to Chase fees, other fees or possibly your down payment, and it doesn't need to be repaid.

Grants can go toward closing costs, fees, discount points, and down payments for non-FHA loans and no repayment required.

Explore home insights

Learn all about your equity and explore market trends.

Equity summary

See your home’s estimated value and explore how you can put your equity to work.

Mortgage details

Review your loan to see how much you’ve paid, your estimated remaining balance and refinance options.

Neighborhood trends

Explore insights and trends for your ZIP code, like recent sales, home listings and the average selling price, to see how your home stacks up.

Refinance

Use our interactive tools to manage your mortgage and see refinancing options.

Explore your options

See what refinancing can do for you, whether that’s lowering your monthly payment, paying off your home sooner or tapping into your home’s equity.

Choose and apply

Chase MyHome will pull the refinance loan options that may work best, so you can choose the right one for you and easily apply.

Start your journey with us

See offers, get your questions answered and start your application all in one place.

Offers

Discover customized lending opportunities chosen for you based on your relationship with Chase.

Apply

Whether you want to buy or refinance, we’re here to help you with your mortgage application.

Have questions?

Get the answers and insights for everything home at the Chase MyHome learning center.

Ready to get started?

Sign in above or download the Chase Mobile® app to access Chase MyHome.