What is a routing number on a check?

If you have a bank account, odds are you’ve heard about routing numbers. Now, you’re looking to understand the part they play in the banking process. You’ll need access to your bank account to provide not only your bank routing number but your account number, too. Your routing number is typically not used frequently enough to memorize or always keep on you, so knowing how to find it at a moment's notice can come in handy.

What is the routing number on a checking account?

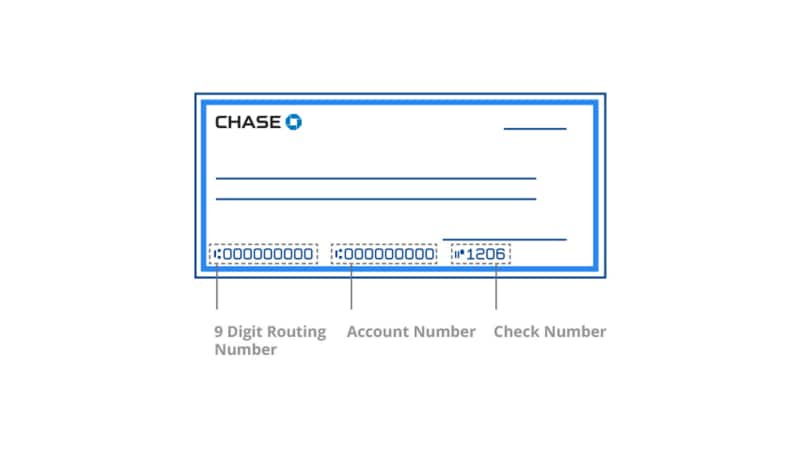

A routing number is comprised of nine digits which identify a specific U.S. bank or credit union in a financial transaction. It comes into play when you’re doing things like scheduling electronic payments, setting up direct deposits or sending and receiving electronic payments through mobile apps.

Routing numbers are also referred to as ABA routing numbers, referring to the American Bankers Association, which is responsible for assigning them out to each financial institution.

Routing numbers are used only within the U.S. and show that the financial institution has an account with the Federal Reserve. This also shows that the account is chartered at either the federal or state level. Large national and multinational banks may have multiple routing numbers, but some banks and credit unions only have one.

How to find my routing number

If you can’t seem to find your check routing number, don’t panic. We’re here to help.

On a check

If your checking account comes with paper checks, this is one of the first places you can look for your bank routing number. Find your routing and account number on the bottom of each of your checks as displayed below.

How to find your routing number without a check

No check? No problem! There are a few ways to find your routing number without using a physical check.

Online

Once you sign in to your account, you can typically find your routing number in the account details section.

Contacting the bank

A bank teller should be able to provide your routing number in person, over the phone or at the drive-through window.

Routing vs. account number: What’s the difference?

Your bank routing number and account number are both essential to ensure that the money is deposited to or withdrawn from the correct account. In simplest terms, routing numbers indicate what bank your account is held at, whereas account numbers are your unique identifier at that bank.

Account numbers are assigned to each account that you own. For example, if you have a checking account and a savings account at the same bank, they’d have different account numbers but one routing number. Your account number provides access to the funds you have stored in your account, so you’ll want to keep it safe.

When do I need my routing number?

You'll need your routing number in a handful of situations, including:

- Setting up direct deposit with your employer

- Receiving a direct deposit from your tax refund, stimulus check or government benefits

- Sending or receiving a domestic wire transfer

- Paying your bills online

- Sending or receiving electronic payments through mobile apps

Now that you know how to access and use your routing number, you’re well on your way to completing your transactions. Happy banking!