Duplicate checks, explained

You may have heard the term “duplicate checks” before and wondered what they were. Duplicate checks are a potentially useful accounting and record-keeping tool that could help you keep track of spending, provide proof of payment and catch accounting errors or fraud. Let’s take a closer look at what duplicate checks are, and how they work.

What are duplicate checks?

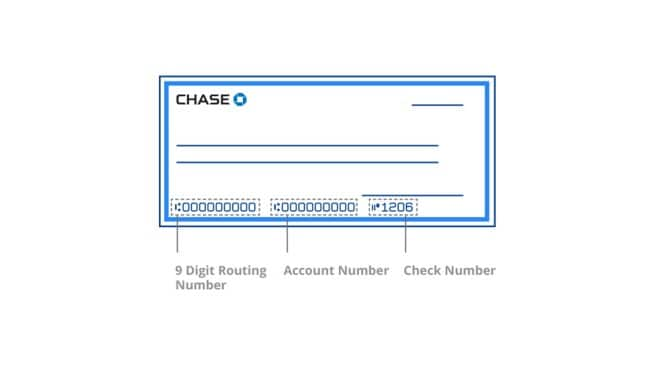

Duplicate checks are carbon copies of standard checks. They’re usually created from an original or single check, using a sheet of carbon paper inserted between them in your checkbook. The carbon paper transfers all your mark-making onto the duplicate check, leaving it with the same information as the original check including the check number, payee, date and amount.

What is the difference between single and duplicate checks?

Single checks are what you typically receive in a standard checkbook; a series of individual checks ready to be written out and used for payment. Duplicate checks come in a special checkbook pre-fitted with carbon paper and two copies of every check. If you’re having trouble deciding between single or duplicate checks, there are a few potentially helpful points to consider.

Benefits of duplicate checks

- Keeping tabs on spending: Having a physical copy of each check for record-keeping purposes might help with tracking your expenses and understanding your spending habits better.

- Account reconciliation: Duplicate checks can be used to reconcile bank statements and help ensure that all transactions have been accurately recorded.

- Fraud prevention: Having a duplicate check may help spot potential check fraud as you can see if the check has been altered.

Downsides of duplicate checks

- Added fees: Carbon paper-fitted checkbooks with duplicate checks may cost more than standard checkbook options. Contact your bank for more information on their specific fees.

- Storage requirements: Because they have twice the number of checks, duplicate checkbooks take up more space than a standard checkbook.

- Potential privacy risk: A check contains a great deal of information about you. From your bank to your spending habits, two copies of a check means two sources of potentially sensitive information.

How do duplicate checks work?

Ordinarily, duplicate checks come in custom-fitted checkbooks designed to create them automatically as you write checks out. Duplicate checks have carbon on the back of the original check. As you date it, sign it and write out the amount and name of the payee, the pressure of your pen transfers your marks onto the duplicate through the carbon paper.

Where to get duplicate checks

Nowadays, some financial institutions no longer offer duplicate checks. Nonetheless, their simplicity and familiarity among many consumers has helped sustain their demand in certain places; speaking with your bank or credit union is the first step in obtaining a checkbook, whether filled with single or duplicate checks.

Duplicate check alternatives

If you prefer single checks or are unable to purchase duplicate checks from your financial institution, there are a few duplicate check alternatives to consider:

- Online banking: Many financial institutions offer online billing systems that allow you to make payments, deposit checks and maintain an electronic record of each transaction.

- Digital copies: Some customers might consider keeping digital records of their checks as they use them.

- Accounting software: Personal accounting software and some budgeting apps may help aid in the record-keeping process in a similar fashion as duplicate checks.

In summary

A duplicate check is a copy of a standard check. It has the same check number and other information as the original and is usually made through a carbon paper insert fitted into a special checkbook. Duplicate checks are commonly used for record-keeping and account reconciliation. To get a set of duplicate checks for yourself, you can try speaking to your financial institution to see if they provide them.