Tips to help avoid a negative bank account

A negative bank account might be a cause for alarm, but staying prepared may help reduce some of those anxieties. Let’s look at what a negative bank account means, some strategies that may help you stay in the black and what to do should you have a negative account balance.

What is a negative bank account?

A negative bank balance occurs when you withdraw more money than you have in your account, also known as overdrawing your account. This may result in overdraft fees, which can quickly add up if you continue to make purchases or withdrawals. In some instances, a negative bank account balance may lead to the closing of your account.

How long can my bank account be negative?

The length of time that your account can be negative depends on your bank's policies. Speaking with your bank may help clarify their policy on negative bank accounts.

How negative can a bank balance go?

There is no one-size-fits-all limit on how negative your bank balance can go. Some banks may set a discretionary limit on how much you can overdraw your account, while others may specify a hard limit.

What does a negative balance on a debit card mean?

A negative balance on a debit card means the balance of the account linked to your debit card is negative.

Will my debit card purchase be approved or declined?

In some cases, you may be able to make purchases even if you have a negative balance. Some banks even offer debit card overdraft coverage to help eligible transactions go through at the bank’s discretion. However, this depends on your bank's policies and the specific type of account you have. Contact your bank for more information on their policies.

Strategies to help stay in the black

While a negative bank balance can have consequences, there are a few steps you can take that may help reduce its likelihood.

Sign up for automated alerts

Some banks may offer automatic low balance alerts that notify you once your account balance has dipped below a certain threshold. These might help provide early warning in the case of a financial miscalculation, accidental overspending or a surprise bill.

Adopt a budget

Creating a budget, and then sticking to it, is foundational to managing your finances and can help you avoid overspending. There’s no perfect budget out there, though there are some common strategies like the 50/30/20 rule that might be helpful if you’re just starting out with budgeting.

Create an emergency fund

Unexpected expenses are a common culprit behind negative bank accounts. By creating an emergency fund, you provide yourself with something of a safety net for unforeseen expenses, whether it be car repairs, medical bills or something else.

Cut expenses

Learning how to track expenses and better understand your spending might highlight ways to help reinforce your emergency fund. Expense tracking can take many forms, but typically involves taking a closer look at your fixed and variable expenses over a set period, to help identify areas where you might be able to cut back.

Use cash

Temporarily using cash instead of a debit or credit card might help you keep better track of spending and avoid overspending.

Consider overdraft protection

Some banks offer overdraft protection which can link multiple accounts or lines of credit together to potentially guard against a negative bank balance, but it's important to understand the fees and terms associated with it. Talk to your bank to find out if they offer overdraft protection and what the requirements are.

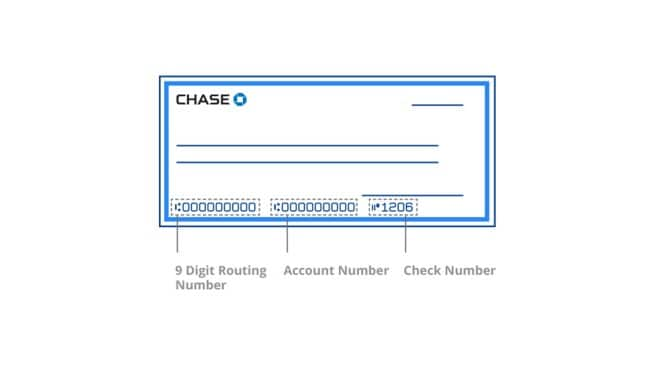

Sign up for direct deposit

Direct deposit lets you deposit recurring income (like paychecks) directly into your account which may help you avoid overdraft fees by ensuring your paycheck is available without the need to visit a branch or ATM to make a deposit. When your paycheck is directly deposited into your account, you can skip waiting for a check to clear or making a trip to the bank to deposit it. Some banks may even offer early direct deposit services that may provide your paycheck up to two business days earlier.

Things to consider when your account is overdrawn

Discovering your bank account balance is negative can be stressful. There are a few steps you can take that may help you get back on track sooner rather than later. Here are some strategies to consider once your account has already been overdrawn:

Stop spending from the negative bank account

The first step to take when you realize your account is overdrawn is to stop spending money from the account. Continuing to use the account is likely to further exacerbate the negative balance, leading to even more fees and potentially more serious consequences.

Speak to your bank

After you have stopped spending from the negative account, you might consider speaking with your bank about your options. Some banks may be willing to waive certain fees.

Consider professional guidance

If you’re struggling with keeping your account in the black, it may also be worth considering seeking guidance from a professional who can help you with creating a budget, developing a savings plan and providing tailored advice to help you avoid future negative balances. Some banks and organizations provide financial education support.

In summary

Maintaining a positive account balance is a critical component of managing your finances. Budgeting basics and a few safeguards might go a long way toward reducing the likelihood of accruing a negative bank balance and any accompanying consequences. In the event of an overdrawn account, it helps to take swift, informed action to mitigate further financial damage. Speaking to your bank about their overdrawn account policies can help keep you informed and better prepared for an emergency.

Enroll now to learn more about Chase overdraft services