What to know about the Employee Retention Credit

Find out whether your business is eligible for this COVID-19 business tax credit. Presented by Chase for Business.

The Paycheck Protection Program (PPP) got all the attention when the CARES Act passed in March 2020, but there’s another COVID-19 response program in that bill that many business owners haven’t tapped into. Even businesses that were ineligible in 2020 could be eligible now, thanks to retroactive changes to the program in 2021.

The Employee Retention Credit (ERC) is a refundable business tax credit created to help business owners keep employees on their payroll during closures and uncertainty caused by the pandemic. Unlike a tax deduction, which reduces your taxable income (and thus can reduce the taxes you pay), a refundable tax credit is a payment to you that’s not limited by how much income tax your business paid. For example, a business that paid $10,000 in taxes in 2021 but qualified for a $12,000 credit through the ERC would receive the full $12,000 credit.

If your business is now eligible but did not claim the ERC for 2020 or 2021, it might not be too late. Let’s review what it takes to make a claim.

Find out if you’re eligible

Did your business fully or partially suspended operations because of governmental orders limiting commerce, travel or group meetings due to COVID-19? If so, it may be eligible to claim the ERC.

However, even if your business cannot point to a specific governmental order, if gross receipts are less than 50% in a calendar quarter in 2020 or lower than 80% in a calendar quarter in 2021 — compared with the same quarter in 2019 — your business may be eligible to claim this credit. Businesses that did not exist in 2019 can use the corresponding quarter in 2020 to make a claim for 2021. Businesses can also make a claim if gross receipts are less than 80% of the immediately preceding quarter in 2020 or 2021.

A thriving business struggles through the pandemic

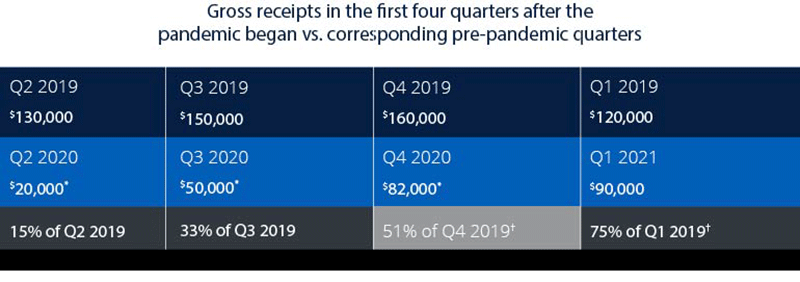

Many businesses saw gross receipts drop sharply in the second quarter of 2020 and increase slowly throughout 2020 and into 2021. Here's how the ERC might apply to one hypothetical business.

*Due to rounding, dollar amounts may not precisely reflect the calculated result.

Q4 2020 is ineligible for the ERC because gross receipts were greater than 50% of the same quarter in 2019. However, Q1 2021 qualifies because the Taxpayer Certainty and Disaster Tax Relief Act set the level at 80%, and gross receipts were 75% of the same quarter in 2019.

Originally, businesses that received PPP loans were not eligible for the ERC, which might have been why the program received less attention. The Taxpayer Certainty and Disaster Tax Relief Act changed the rules and retroactively broadened eligibility, including for businesses that received PPP loans. Unfortunately, many business owners and accountants may be unaware of this change.

How much a business can claim has changed over time and is based on eligible wages and number of employees. For full details and more information on ERC eligibility and how to calculate your potential credit, visit the IRS website.

Claim your credit

If your business slowed during the pandemic, the ERC could offer the cash you need to get back to full speed. Businesses that employed even one or two people in 2020 or 2021 could receive thousands of dollars through this tax credit.

It’s smart to consult a tax professional before claiming the ERC, especially since your claim would need to be filed after the deadline for 2021. Eligible businesses that filed their taxes for 2020 or 2021 may need to file amended returns.

For more information about the ERC, go to the IRS website.