Small companies can get tax credits for starting a 401(k)

Tax credits make it affordable for small companies to offer a 401(k) plan. Presented by Chase for Business.

Between legal fees, vendor costs and more, launching a basic 401(k) plan can cost a business owner more than they think they can afford. Consider a fictional company called Sunnyvale Construction for example, with seven employees paid the following annual salaries:

- An admin/office manager earning $40,000

- A skilled construction worker earning $45,000

- Another skilled construction worker earning $50,000

- An equipment operator earning $50,000

- A construction estimator earning $60,000

- A General Contractor/Foreman earning $80,000

- The owner earning $120,000

The company wants to provide 401(k) benefits to retain current employees and attract new talent. But the potential hefty setup fees and the ongoing costs of contributing to the plan make them wonder whether this is a smart financial move right now.

Tax credits cut the cost of starting a 401(k)

Then, the Sunnyvale team learns about tax credits that make launching a 401(k) much more budget-friendly.

These tax credits are part of two laws passed by Congress, called SECURE and SECURE 2.0. The goal of both acts is to make it more affordable for a small business to offer a retirement plan to employees and to make it easier for employees to save for retirement.

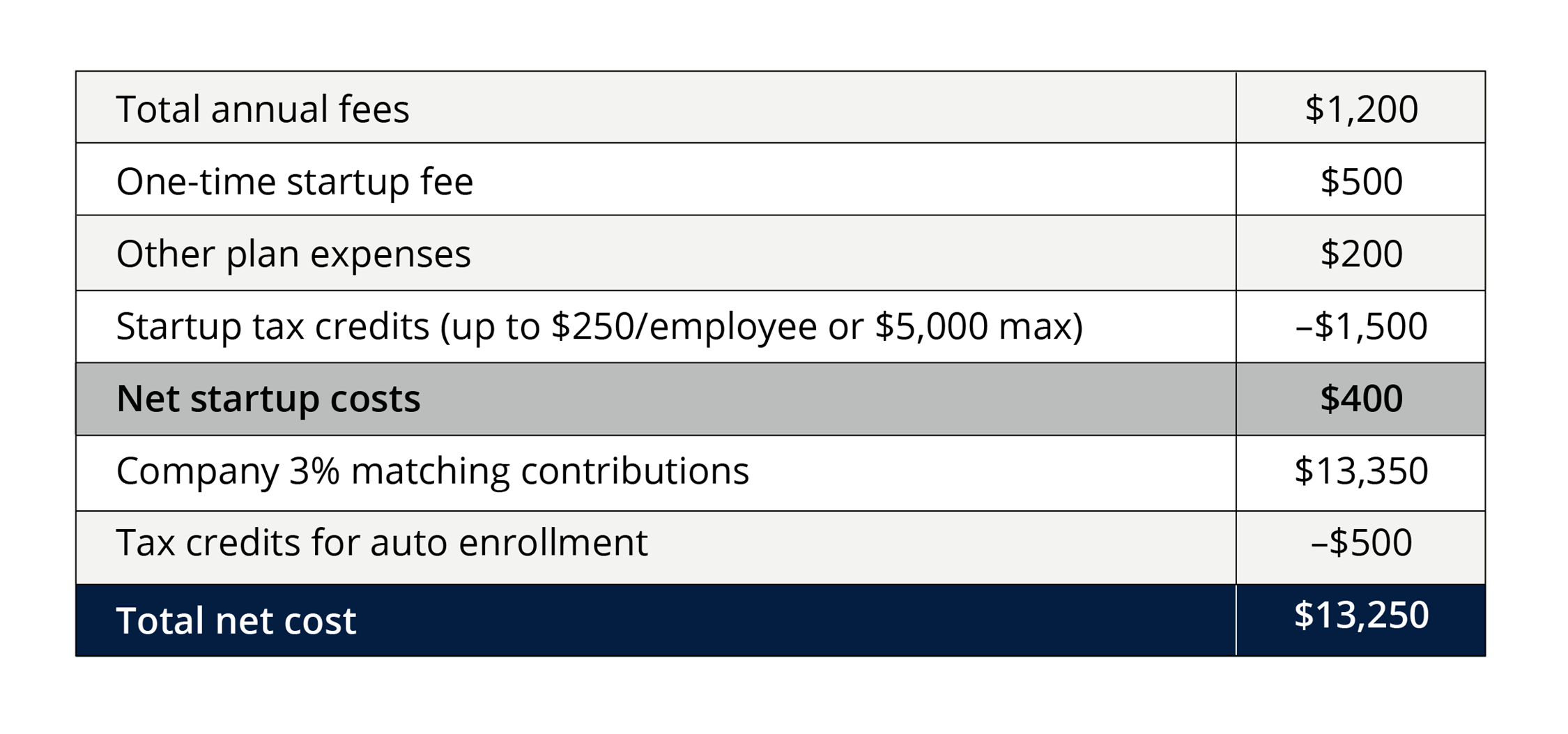

With these tax credits, small companies, like Sunnyvale, with 50 or fewer employees can get a tax credit to cover their retirement plan startup costs up to $5,000.retirement-enhancement-secure-act Plus, if they offer auto-enrollment, they will get an additional $500 tax credit. That means Sunnyvale’s out-of-pocket startup costs could drop significantly, especially if they start an Everyday 401(k) plan with its low startup costs when the tax credit is applied.

Tax credits make it affordable for small businesses to contribute

Now that they know they can afford to offer a 401(k), the Sunnyvale team wants to match employees' 401(k) contributions if they can afford it. At first glance, the costs of matching employee contributions seem too high:

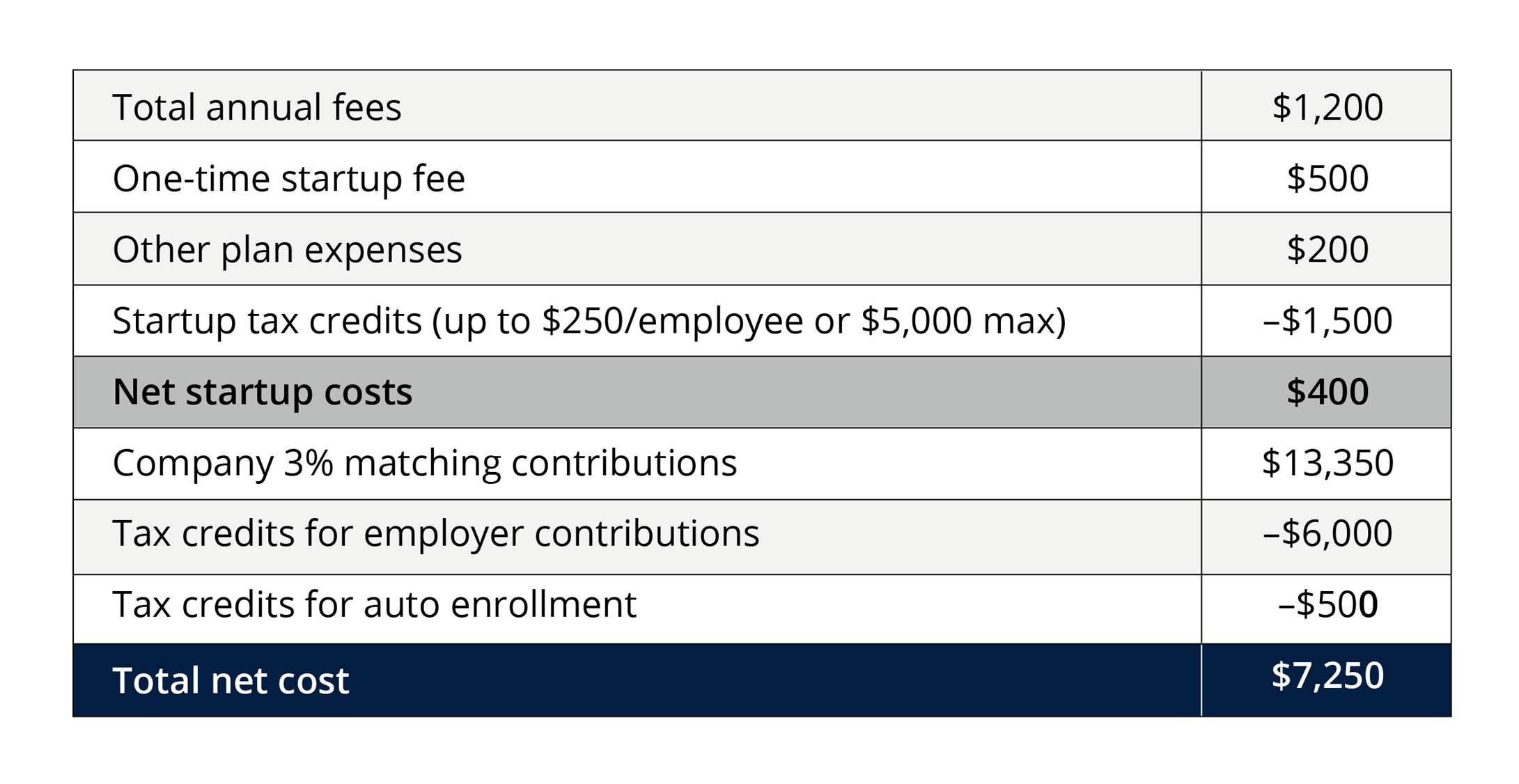

Then Sunnyvale discovers that SECURE 2.0 also includes a tax credit for small businesses that contribute to their employee 401(k) plan.

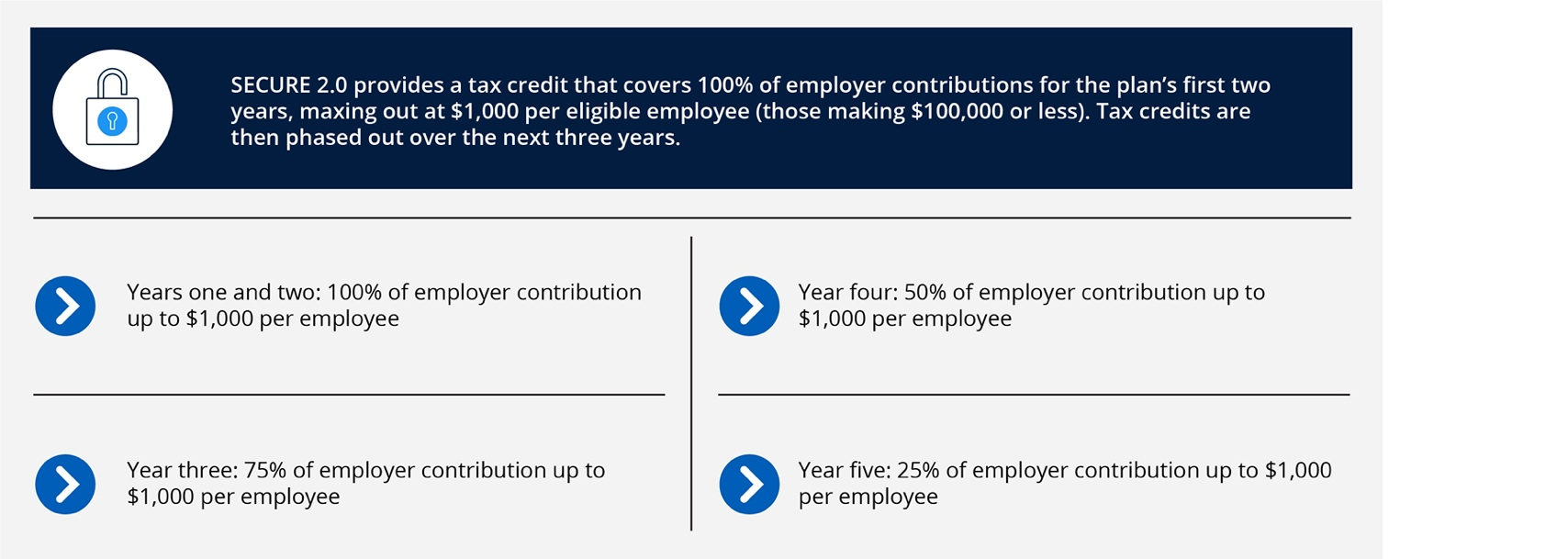

This tax credit covers up to $1,000 of the contributions that a small company makes to each qualified employee's 401(k) account for the first five years.internal-revenue-code-section-45e-f It applies to employees who make $100,000 or less per year, with a max tax credit of $1,000 per employee each year.

At Sunnyvale, the owner is the only person who doesn’t qualify for the credit because they earn more than $100,000. But for the rest of the team, that $1,000 credit per employee adds up to $6,000, which makes the costs look much more doable:

And keep in mind, almost half of the total net cost is for Sunnyvale’s 3% contribution into the owner’s 401(k) account ($120,000 salary x .03 = $3,600).

Overall, SECURE 2.0’s tax credits make it possible for Sunnyvale to match 401(k) contributions for every employee, including the owner.

Small businesses can offer employees a 401(k) plan that fits their goals

By breaking down the biggest barriers that have kept too many companies on the retirement savings sidelines, SECURE and SECURE 2.0 clear the way for small businesses like Sunnyvale to offer 401(k)s to their employees.

Through expanded tax credits that can make launching a plan more affordable, business owners can provide employees with the support they need to save for retirement. Having more access to retirement plans in the workplace means it’s easier for employees to save consistently to meet their financial goals.

By helping to ramp up retirement readiness, SECURE 2.0 boosts the financial well-being of small companies, their employees and the entire economy.

Want to learn more? Complete our online form to speak with a Retirement Plan Specialist about affordable 401(k) plans for your small business.