Chase Payroll

Enjoy simplified payroll embedded in Chase Business Online, freeing you to focus on your business while helping you to stay ahead of payroll taxes.

Exclusively available to Chase Payment Solutions℠ clients.

Built for Chase clients

Embedded into Chase Business Online. One login for easy management of all your critical business needs — payments, payroll and more.

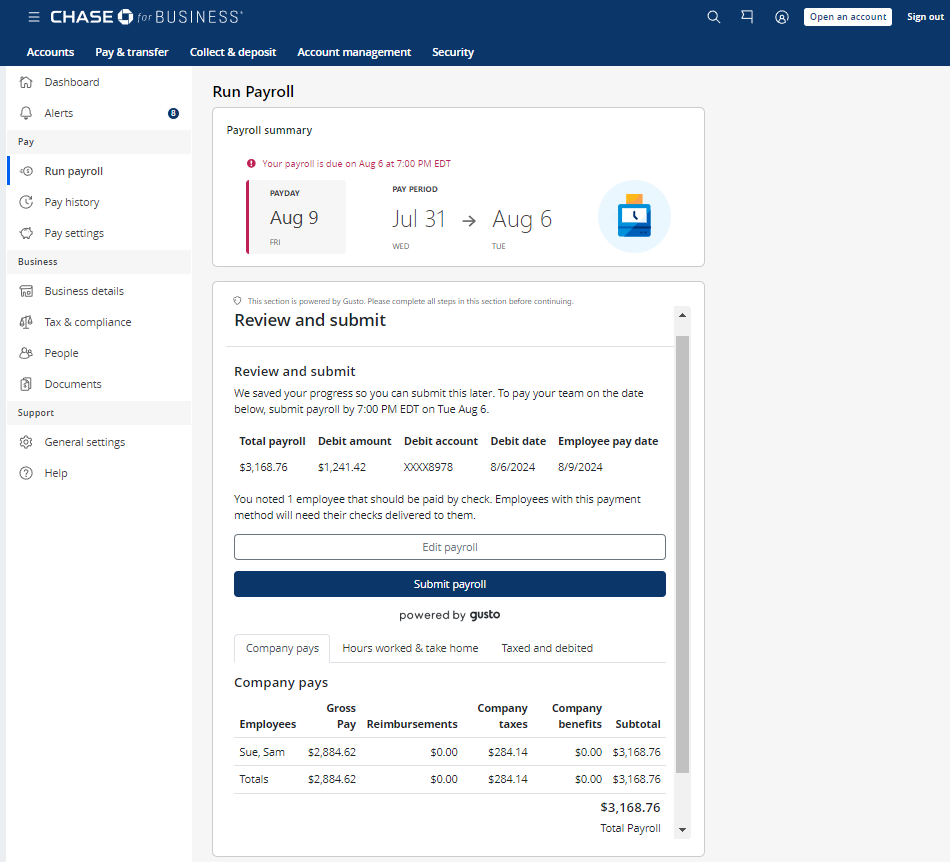

Powered by Gusto

We’ve partnered with a leader in the payroll industry with proven experience, to provide you with a payroll service you can count on.

Stress-free tax support

Our solution accounts for changing tax laws and accurately calculates and files your payroll taxes automatically, freeing you to focus on your business.

Run payroll in just a few clicks

Easily pay your team, while saving time and effort.

"Chase provides a sense of security with my personal and business accounts.

Chase Payroll gives me the security of knowing my employees will be paid on time."

Leah Bostick

Human Resources, Southwest Flooring Supply

Customers were told in advance they might be featured in an ad.

A leading partnership

We take pride in the trust we’ve built with our clients. That’s why we chose to partner with Gusto, a proven payroll leader.

Gusto named #1 Payroll Software of 2024

12+ years

Gusto’s experience in building and selling payroll

Set up, run and manage payroll with ease

Set up, without the hassle

Our simplified, digital onboarding makes getting started easy. Plus, because you are a Chase Payment Solutions client, we can prefill much of the information needed for you.

Empower employees, save time

Once hired, your team can enter their details and get set up on their own using Gusto’s employee portal, which automatically syncs with Chase Business Online.

Switching to us is easy

No matter the time of year, switching to Chase Payroll is easy because of our simple digital setup process with step-by-step guidance.

"With my last payroll company it took two weeks to onboard. Chase eliminated all that stress because I was able to complete everything in one day."

Leah Bostick

Human Resources, Southwest Flooring Supply

Customers were told in advance they might be featured in an ad.

Conveniently built into Chase Business Online

Run your business on your schedule

Enjoy unlimited payroll runs across all 50 states at no additional cost. Plus, the payroll dashboard summarizes pay period and payday in a snapshot, making it easy to review and pay your team on time and with accuracy, at the click of a button, no matter where you are.

Automatic tax calculations, filings and documents

Stay on top of taxes with ease, accuracy and peace of mind

We help you stay in sync with the latest tax regulations. Enjoy automated local, state and federal tax calculations, filings and compliance support from an expert in the industry.

No hidden fees or long-term contracts

$39/month

including first person paid

+$5/month for each additional person paid

Get started with Chase Payroll

Existing Chase Payment Solutions client?

Not available for QuickAccept® clients at this time.

New to payments?

Connect with a Payments Advisor to find the right payment solution for your needs by filling out this short form.

Unparalleled value from payments and banking in one place

Fast access to funds

Improve cash flow with deposits as soon as same day at no extra cost when deposited into a Chase business checking account.

Sell with confidence

Chase’s fortress-level security, industry-leading systems and Fraud Protection services help keep your payments safe.

One-stop shop for your financial needs

One login to manage payments, banking and business analytics to help you grow.

Grow and optimize your business

Chase Customer Insights

A business intelligence platform with analytics you can use to better reach customers and manage your bottom line.

Plus, now you can run Google Ad campaigns through Customer Insights.

Special offer: new Google Ads customers will get $500 in Ads credit after spending $500.

Frequently asked questions

Chase Payment Solutions clients located in the United States. At this time, it is not available to QuickAccept clients, who accept payments through their Chase Business Complete Banking account using solutions like Tap to Pay on iPhone, the Chase Point of Sale (POS)℠ app, the Chase Card Reader™ or Chase Point of Sale (POS)℠ Terminal.

Chase Payroll costs $39 per month for the first employee, plus $5 per month for every additional employee. Each month, you will be charged the per person cost for each active employee, even if you haven’t paid them. You will only be charged after running your first payroll. We do not charge for additional payroll runs. You can run payroll as many times as you need each month, at no additional cost.

Chase Payroll allows you to run payroll in Chase Business Online. You are required to have a Chase Payment Solutions account. Payroll processing is powered by Gusto.

Run payroll, taxes and filings, time tracking, employee management and more.

W-2 forms and 1099s are filed on your behalf and employees receive electronic copies of their forms as well. I-9 forms are not currently stored in Chase Payroll. It is your responsibility to keep I-9 forms on file for all employees.

No, there are no annual or long-term contracts. You must agree to the applicable Terms of Service for Chase and Gusto during onboarding, but you can cancel at anytime.

Gusto is HIPAA, ERISA and ACA compliant to keep employee information secure and to comply with federal regulations.

We offer 4-day ACH direct deposits to employees.

ACH Payroll is a basic payroll solution that only allows you set up employees and send them ACH payments. Chase Payroll is an end-to-end payroll solution that offers payroll management, tax calculation and filing capabilities, as well as the ability to set up and pay employees.

Need help with Chase Payroll?

Find the answers you need and get payroll support.