Our most popular checking account, chosen by millions

Monthly Service Fee

$12 or $0 fee (Effective 8/24/25, $12 changes to $15) with direct deposits totaling $500 or more, or a minimum average daily balance each statement period.

Pay bills securely from anywhere

Pay all your bills with no fees on the Chase Mobile® app or Chase Online℠ without sharing your account details.

Manage your money on the Chase Mobile® app

Zelle® and Chase QuickDeposit℠ make sending, receiving and depositing money a breeze online or with the Chase Mobile app — and lock your debit card directly from your phone if you misplace your card.

Access to 15,000 ATMs and over 4,700 branches

Whether you need to visit a branch or an ATM, you can access your money when you need it.

$12 or $0 Monthly Service Fee

(Effective 8/24/25, $12 changes to $15)

You can avoid the fee by doing one of the following each monthly statement period:

Electronic deposits made into this account totaling $500 or more, such as payments from payroll providers or government benefit providers, by using (i) the ACH network, (ii) the Real Time Payment or FedNow℠ network, or (iii) third party services that facilitate payments to your debit card using the Visa® or Mastercard® network,

OR a balance at the beginning of each day of $1,500 or more in this account,

OR an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings and other balances

Help keep your

money protected

With Zero Liability Protection, you'll get reimbursed for unauthorized charges on your debit card when reported promptly. Chase Total Checking also includes FDIC Insurance up to the maximum amount allowed by law.

Pair a Chase Savings℠ account with Chase Total Checking

Open a Chase Savings℠ account at the same time as your Chase Total Checking account to manage your money in the same spot.

Chase Savings℠

Savings made simple with our most popular savings account.

$5 or $0 Monthly Service Fee

How to avoid the fee | See account details

Chase Total Checking

Our most popular checking account with all the banking essentials.

$12 or $0 Monthly Service Fee

(Effective 8/24/25, $12 changes to $15)

FAQs

Learn more about your Chase Total Checking account by reading our frequently asked questions.

You can bank from anywhere with the Chase Mobile® app. To enroll, download the app on your phone or tablet or go to chase.com

There are several ways to easily add money to your bank account:

- Transfer money from another bank.

- Set up direct deposit from your employer.

- Use Chase QuickDeposit℠ to take a picture and deposit a check through the Chase Mobile app.

- Use Zelle® to get paid back with people you know and trust right in the Chase Mobile app.

- Deposit checks and cash at Chase branches and ATMs.

You can pay your rent, mortgage, credit card and other bills with Chase Online℠ Bill Pay. You can also add your debit card to your mobile wallet and use your phone to make purchases. This allows you to make secure payments even when you don't have your physical card.

You can use Zelle® right in the Chase Mobile® app to pay and get paid back fast with people you know and trust who have an eligible account at a participating financial institution. More than 1,000 banking apps in the U.S. offer Zelle® so you can use it with people you know and trust — even if they don't bank with Chase.

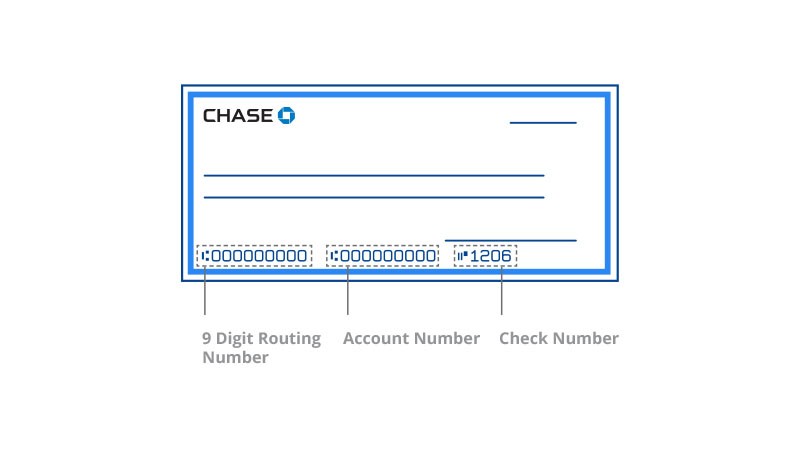

You can find them using the Chase Mobile app or on chase.com by following these simple directions. Once you have your checks, you can also find them on the bottom of each check.