What is a business line of credit and how does it work?

Want to grow your business? A line of credit can be more flexible than a credit card. Presented by Chase for Business.

For many small business owners, finding ways to expand is a priority — whether by hiring some help, remodeling your space or bringing in more inventory. But growth takes money. When your cash is committed to other things or revenue fluctuates, besides a business loan, a small business line of credit could give your company the financial flexibility to take the next step.

What is a business line of credit?

A line of credit gives your business access to a set amount of financing that you can access as needed for short-term business needs: inventory, renovations, business expansion, marketing campaigns and more. You pay interest only on the amount you use. And unlike a business loan, a business line of credit allows your business to access cash without taking on a lot of debt all at once. Typically those repaid funds become available to access again.

A business line of credit can give you access to cash just when you need it, but as with any financing option, the details matter. Here are some things every business owner should understand.

Key benefits of a business line of credit

Let’s look at an example of how a business line of credit might work. Say you own a bookstore and need $50,000 to expand into the space next door. After getting approval for a secured line using your store real estate as collateral, you can access the $50,000 for renovations and inventory.

As you use the funds, interest starts accruing only on the amount withdrawn. For example, if you use $10,000 for renovations, then you pay interest only on that amount and still have access to the remaining $40,000 if you need it. As you pay down the $10,000 of principal, you free up that amount of credit to borrow again.

One of the key benefits of a business line of credit is that you can access the cash, pay it back and borrow again as you go. It’s flexible financing that doesn’t tie up your business’s working capital. There are other potential benefits as well. You can start building business credit and establish a relationship with a lender. You have the option to use the credit as an emergency buffer and a source of cash on hand. You also may be able to negotiate more favorable interest rates than you’d get from another type of loan or credit card.

How does a business line of credit work, and how does it differ from options like business credit cards? Let’s take a look.

Business line of credit vs. business credit card: How do they compare?

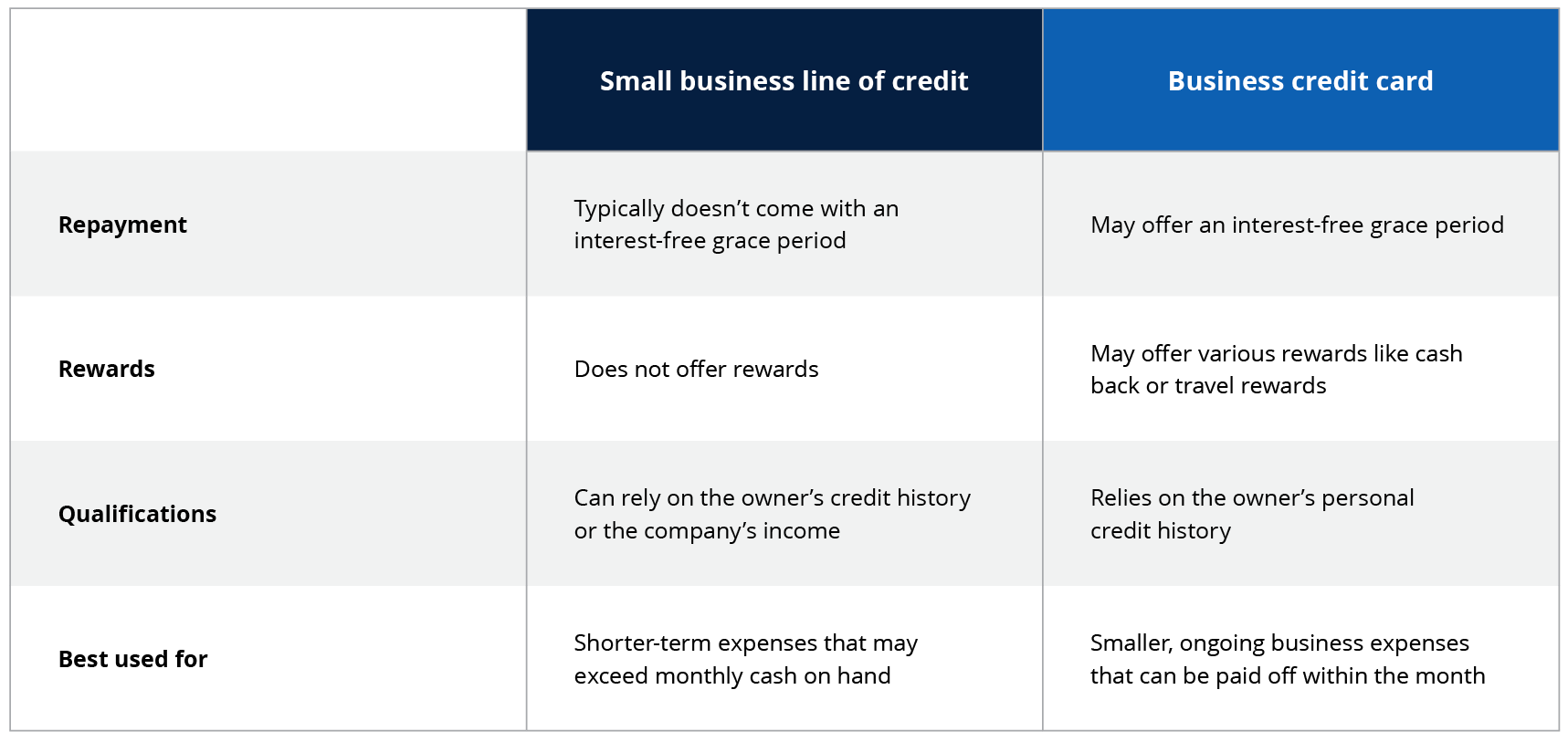

At first glance, a business line of credit and a business credit card may seem pretty similar. They’re both revolving credit you can access for funds. But once you dig in, some key differences emerge.

With a business line of credit, you can draw what you need, when you need it, and make interest payments on just that portion until you pay down the principal. Credit card balances typically have set minimum monthly payments and interest charges on the full balance each billing cycle. You might consider using a business credit card for your LLC to separate daily personal and business expenses.

One area where a business credit card has an advantage is the approval process. With a credit card, the process can be quicker and easier because issuers are looking more closely at your personal credit history than your business’s. A line of credit, on the other hand, has a much higher credit limit but involves a more rigorous approval process that examines your business’s performance.

Here’s the main takeaway: A business credit card is great for covering smaller everyday expenses like office supplies or meals out with clients. A business line of credit is often used for larger, less frequent financing needs like expanding locations, funding inventory orders or covering gaps in cash flow.

How do you use a business line of credit?

A business line of credit can really help when you need access to capital at a lower interest rate than a credit card offers. Once approved, you can draw on the funds as needed without reapplying each time.

Let’s look at how a business line of credit might work. Imagine you own a landscaping business and want a line of credit to cover winter costs until spring contracts resume. Here’s what you might need help with:

- Revenue fluctuations. A line of credit provides funds for expenses like employee payroll and supplies during the slow season when revenue dips. Rather than tying up cash reserves to operate through winter, you can use your line of credit.

- Cash flow gaps. Until spring arrives and business picks up again, the line lets you even out those cash flow gaps and keep operating smoothly. No need to scramble for financing or stall operations.

- Business investments. If an opportunity comes up to invest in a business website or employee training, the business credit line lets you jump on it without drawing from your working capital.

- Emergency expenses. If a major truck repair or new equipment is needed, the line offers a backup source to draw from so that you aren’t scrambling to come up with the funds.

In short, a business line of credit can provide business funding to cover things like seasonal revenue changes, emergency costs or unexpected growth opportunities.

Is a line of credit right for you?

How do you decide whether getting a line of credit makes sense for your specific business? Here are some questions to consider:

- Do you have slow or busy seasons that make your cash flow go up and down at certain times of year? A line of credit can help smooth out those highs and lows.

- Are you planning any big purchases or expansions soon that require extra financing? A line of credit can provide funds to draw upon as needed for growth plans.

- Is your business missing out on opportunities because you don’t have capital on hand? With a line of credit, you can act fast when a good opportunity comes up.

- Do you have a rainy-day fund to cover repairs or emergencies? If not, having a line of credit can be a way to cover unexpected costs.

In short, a line of credit can provide you with business funding to cover things like seasonal revenue changes, emergency costs or unexpected business growth opportunities.

For instance, a small marketing firm might decide to establish a $30,000 business line of credit because customers are often late with payments. Having a line in place can help the firm manage payroll through cash flow dips.

Likewise, if you want to smooth out cash flow for your business, set up a backup fund for emergencies or simplify payments to your lenders, a business line of credit might be the right move.

Think a business loan could be a good fit for your business? Read our guide on how to apply for a business loan and get more info on the requirements.

Using a business line of credit to grow

For many businesses, a line of credit can be a helpful source of flexible financing. Compared with a conventional loan or high-interest-rate credit card, a business line of credit lets you access money as needed instead of taking it all in a lump sum that accrues interest. This makes a line of credit handy for all kinds of business needs, such as managing slow seasons and buying new equipment.

Look at your own business situation to see if a line of credit fits your needs. You may find that a line of credit can provide the funding your company needs as it grows, giving you a financing option that evolves along with your short-term needs and long-term goals.

Want to talk about more ways to help strengthen your business or grow your company? Reach out to a Chase business banker today. We’re always ready to help.

FAQs about business lines of credit

What are secured and unsecured business lines of credit?

There are two ways to categorize a small business line of credit: secured and unsecured. A secured line of credit requires you to offer an asset or assets as collateral, which can help if you don’t have a strong credit history. On the other hand, an unsecured line of credit doesn't require collateral but typically relies more heavily on your creditworthiness and income. While secured lines can be a good fit for borrowers with limited credit history, unsecured lines can be quicker to apply for and might be available if you have good credit. Chase Business Banking typically provides secured lines of credit.

What are the requirements for a small business line of credit?

There are various requirements you should be aware of if you want to apply for a small business line of credit. Lenders will assess your company’s financial history, including your business credit scores, personal credit scores of any guarantors you might have, company assets, cash flow and years in operation. Lender requirements vary, so be sure to check with yours before applying.

After you’re approved for a business line of credit, the lender will provide you with access to the line of credit, which you can use as needed. As the borrower, you will repay that line of credit over time.

Depending on the lender, there may be fees associated with your small business lines of credit, which could include origination fees, monthly fees and annual fees — the latter two are usually charged if you don’t use your line of credit. Please note that fees can vary significantly from lender to lender.