Imposter fraud, unmasked

Understand how imposter fraud works and how to spot a scam. Presented by Chase for Business.

What you need to know:

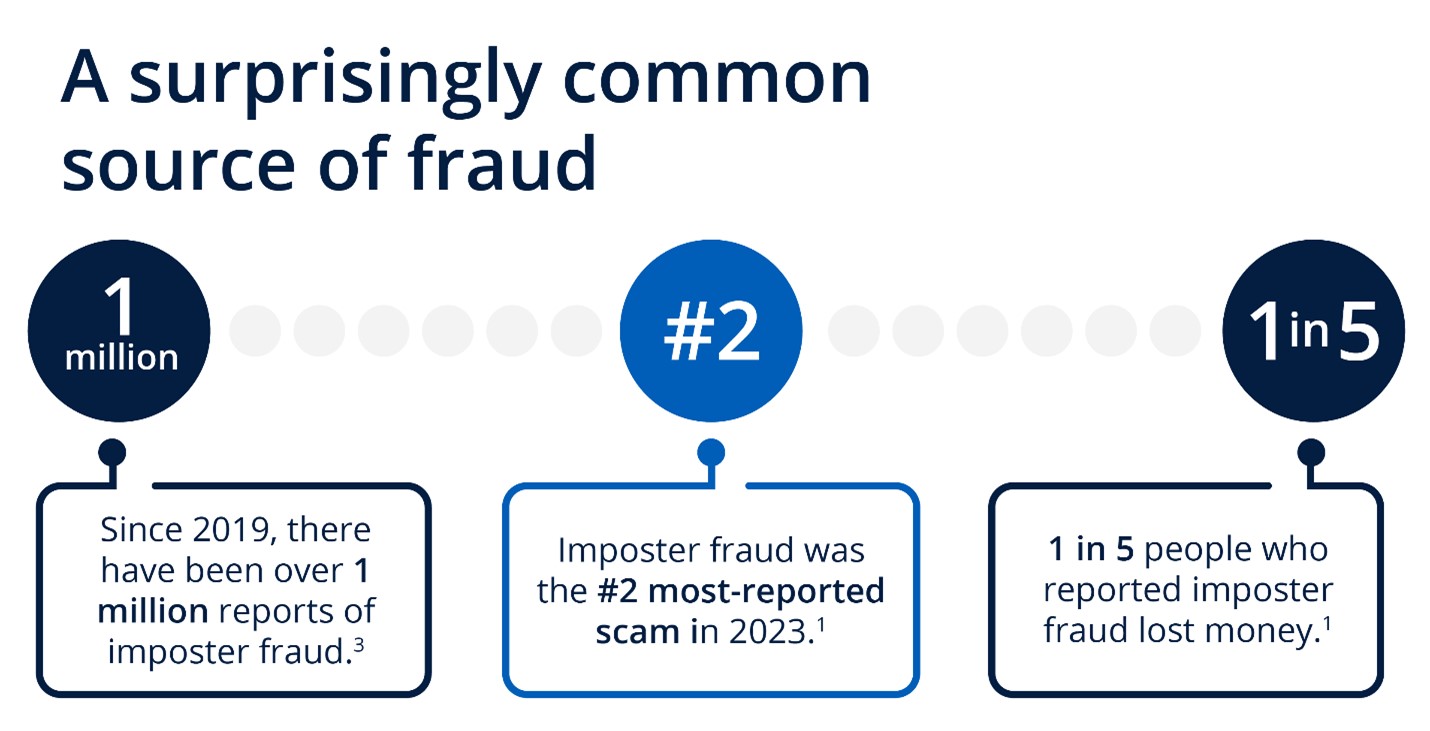

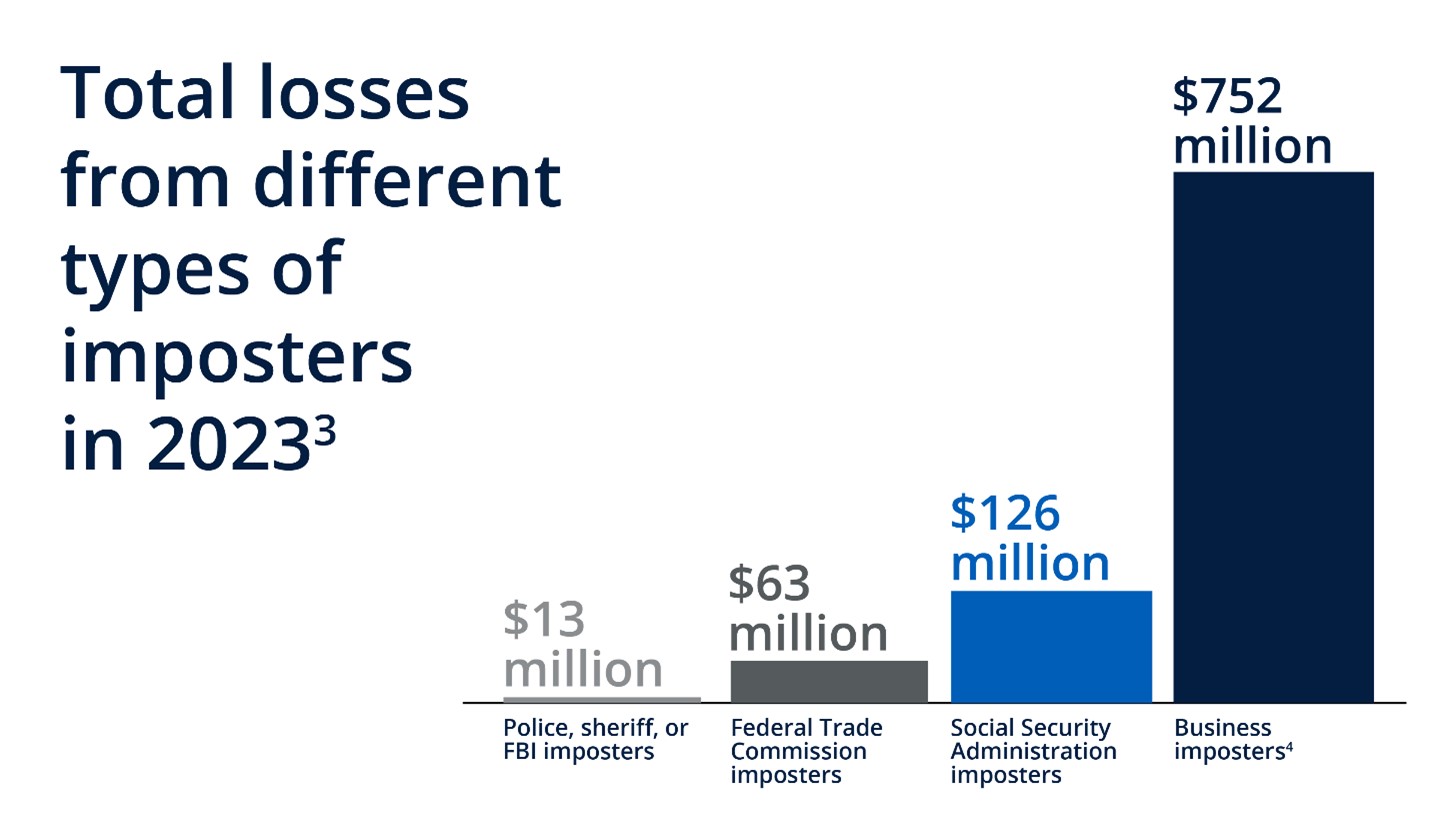

- Imposter fraud is a common type of scam that costs consumers and businesses billions of dollars per year.

- It occurs when a scammer claims to be someone they’re not, such as a government agent or bank employee, to convince their victims to send them money or divulge personal information.

- Advances in technology are making it more difficult to spot imposter scams. But there are common patterns you can look for and practical steps you can take to help protect yourself and your business.

Fraud is big business. The latest data from the Federal Trade Commission, a government agency that enforces consumer protection laws, reports that people lost $10 billion to fraud in 2023. Of that total, $2.6 billion was lost to imposter fraud, making it one of the most common types of schemes.

Fraud doesn’t affect just individuals. Business owners are also a target, with companies losing roughly 5% of their revenue to fraud each year. Small businesses are especially vulnerable because they’re less likely to invest in advanced security measures or dedicated IT teams. No matter your resources, you can still take steps to help protect yourself, your employees and your business.

What is imposter fraud?

Imposter fraud occurs when a scam artist pretends to be someone else to convince their victims to send them money or divulge personal information. For example, they might pretend to work for a financial institution or a government agency. With advances in technology, many scam artists can even realistically impersonate a coworker, relative or friend. No matter how savvy of a consumer you are, these technologies are making it harder to tell what’s real and what’s a total scam.

Common signs of imposter fraud

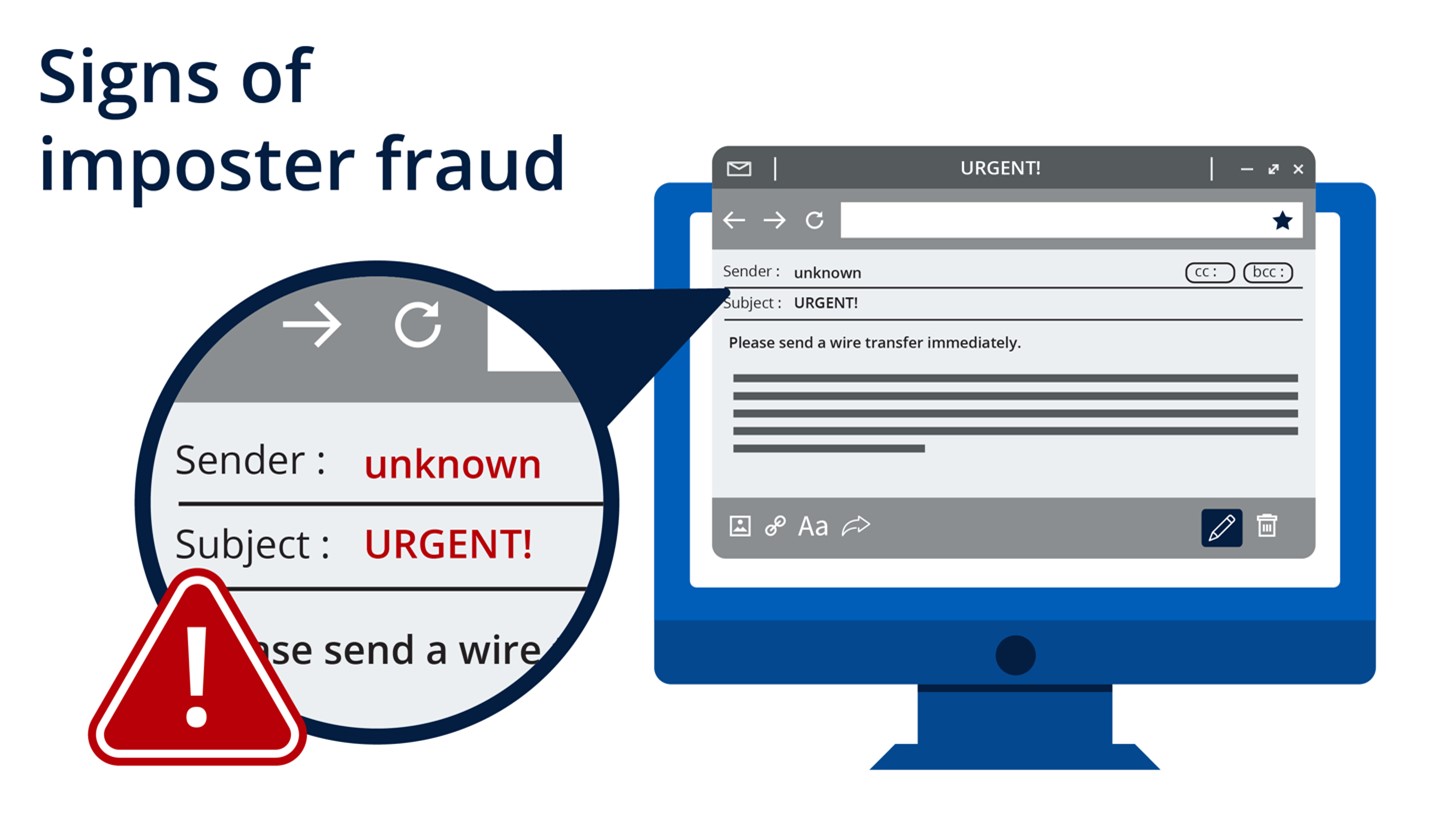

Imposter fraud tends to follow a formula. Once you’re familiar with some of the most frequent patterns, you’ll be better able to spot them. Here are some examples:

- You’re asked to send money via wire transfer, gift card, cryptocurrency or payment app.

- You’re told that you need to move or transfer your money to a different account to protect it or to prevent a freeze on your assets.

- You receive an urgent message from an unknown email address or phone number, often from someone who claims to work for the government, a financial institution or a small business.

- You’re asked to share sensitive information — such as your Social Security number, credit card number or bank account details — online or over the phone.

Spotting fraud comes down to noticing the little things. Let’s look at two scenarios that help illustrate imposter fraud in action.

Scenario one: Suspicious email

You work at a small business and regularly correspond with your CEO. As you’re scanning your inbox, you see a message from your boss with the subject line “Please read! I need your help.” The message says that you’re in danger of losing a big client if you don’t immediately click on a link to buy them gift cards. The message looks like it’s from your boss’s real email address, but with one letter cut off. Do you click the link?

This scenario shows a few signs of an imposter scam:

- The email is from a known sender.

Many scam artists use email addresses that seem credible, often from people or businesses that you interact with. But if you look closely, you’ll notice that the address is slightly off.

- The subject matter is urgent.

Scam artists create urgent situations that pressure people to act quickly. This helps them take your money before you’ve had time to think critically or do research.

- They’re asking you to buy gift cards by clicking a link.

Scam artists use links to steal your information. It’s best practice to never click a link in an email from an unverified sender.

Scenario two: Call from an unknown number

You receive a call from an unfamiliar local number, and the person is claiming to be a banker. They say that your accounts are overdrawn and will be frozen unless you confirm your account and routing numbers.

This scenario shows three signs of an imposter scam:

- The call is from an unknown number.

Although scam artists could be calling from anywhere in the world, caller ID spoofing can make their number appear local.

- The caller claims to be a banker.

Imposters will try to earn your trust. One way they do that is by appearing to call on behalf of a financial institution or government agency, such as the IRS or Social Security Administration.

- The stakes are high.

Scam artists want to pressure you into acting quickly. By posing as someone in a position of authority, they’re trying to scare you into immediate action.

Tips to help avoid imposter fraud

The best way to avoid imposter fraud is knowing how to spot it. Staying up to date on the latest schemes and fraud technology is crucial. Follow this list of best practices and share it with your employees to help your business avoid becoming a victim:

- Verify that you’re sending money to the intended recipient by calling them on a known number, especially if you’re asked to pay via wire transfer, gift card, cryptocurrency or payment app.

- Never share personal information online or over the phone with an unverified source. If you feel at all suspicious, hang up or close your browser.

- Use caution if you’re being pressured to act immediately or threatened with serious consequences if you don’t act now.

- Avoid answering calls from unknown numbers. Scammers can use your behavior on these calls to identify you as a potential target.

- If you’re not sure whether a call or message is real, look up the person or agency directly. To verify what they’re saying, call a number that you know is correct.

- Don’t click on links in emails, texts or social media messages that you aren’t expecting or are from people you don’t know.

- Don’t trust your caller ID. Even if your caller ID shows the name of a real government agency, it could be a spoof.

Help keep your business safe from scam artists

It’s not always easy to spot fraud, but the tips above can help you avoid being the victim of a scam artist. Share this information with your employees, too, so they’re less likely to put your business at risk. Remember, you always have the power to hang up the phone, delete the message and disengage.

Adding extra security measures can also provide peace of mind. Chase Fraud Protection Services can help through Check Monitoring, Check Protection Services and ACH Debit Block. Reach out to your business banker to learn more.