7 principles for a successful retirement

It’s never too late — or too early — to start planning ahead. Presented by Chase for Business.

Setting up retirement for yourself and your employees can feel overwhelming. Some factors are out of your control, like market returns and the future of tax policy. Focusing on what you can control can give you more confidence in securing your future.

Planning for retirement as a business owner may feel lonely, but you don’t have to do it alone. Learn seven essential retirement planning principles to help you make more informed decisions and take steps toward a successful retirement.

1. Plan for a long life

The longer you live, the longer your investments must last.

Did you know that at least one member of a 65-year-old couple has a nearly 50/50 chance of reaching 90? Some are likely to live much longer: More than 1 in 10 women and nearly 1 in 10 men are projected to make it to 100 or older if they self-report non-smoking and excellent health. And keep in mind that with new medical advances, family history is not destiny, so you may live longer than your parents and grandparents. Living longer is a wonderful thing. It also affects key retirement decisions such as how to make the most of your time, how to invest, when to claim Social Security and whether to plan for long-term care.

Your retirement plan may need to account for 35 or more years of living expenses. That means your investments need to continue growing long after you sell your business to keep pace with inflation and last as long as you need them to.

2. Know how much you’ll need

Saving money during your working years is the key to a successful retirement. The exact amount you need to set aside will vary based on your individual circumstances, with the goal of balancing the needs of your current and future self.

Generally, some experts recommend saving 10% of your gross annual income, which is significantly more than the average annual savings rate in the United States. The good news is that it’s never too late to start saving more. The earlier you start, the more your investments can grow.

As a business owner, it’s your responsibility to save and plan for your own retirement. (And possibly help your employees plan ahead, too.) It can be helpful to work with a financial advisor to set goals and create a realistic road map that can help you stay on track even as your life, the markets and the economy change. Consider your options for individual or group retirement plans, such as a SEP IRA, a SIMPLE IRA or a traditional or Roth 401(k). With the passage of SECURE 2.0 Act, you may be eligible for tax credits for starting a new workplace retirement plan. Consult your tax professional for more information.

3. Make an informed decision about Social Security

With Social Security benefits, it can pay to wait.

Paying Social Security taxes makes you and your employees eligible to receive Social Security benefits. Your benefits are calculated based on your 35 highest earning years, but when it comes to claiming your benefits, timing matters.

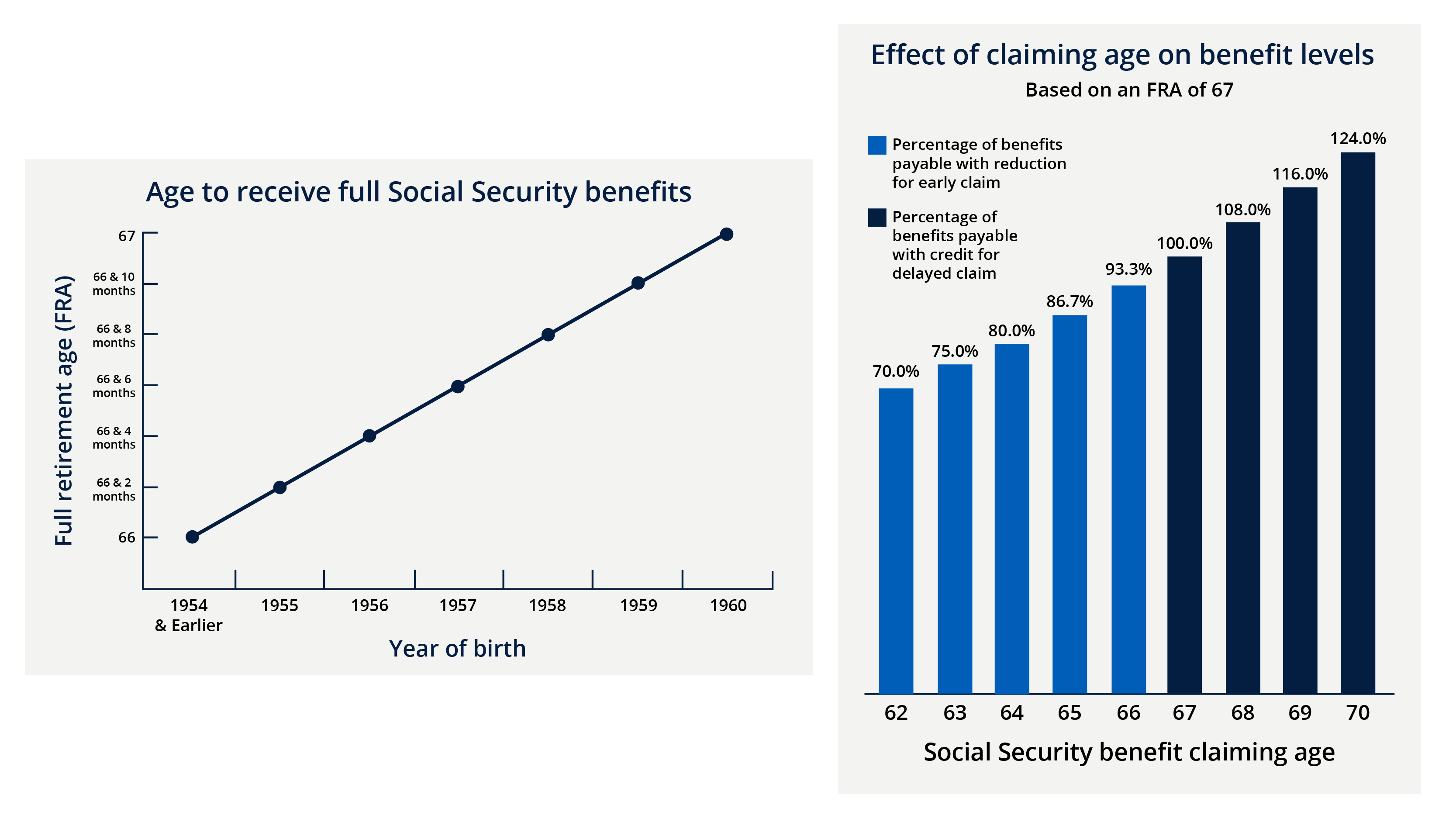

You’re eligible for 100% of your benefits at your full retirement age (FRA). If you claim before you reach FRA, you’ll receive a lower monthly payment because you’ll essentially have a longer claiming period. If you claim when you’re older, you’ll receive a larger monthly payment but for fewer years.

Your FRA depends on what year you were born. The FRA is 66 for people born in or before 1954 and 67 for those born in 1960 or later. In 2017, the FRA began to transition from 66 to 67 by adding two months each year for six years, so those born between 1954 and 1960 have different FRAs. See the chart below for details.

Given the trade-offs around timing and the dollar amount of benefits, it’s important to consider your longevity before making your election. If you expect to live a relatively long life and can afford to wait, it can be beneficial to claim your Social Security benefits closer to or at your FRA, or even to wait until you turn 70 to maximize your lifetime payments.

4. Understand rising health care costs

Plan on rapidly rising expenses.

Medical expenses tend to rise sharply throughout retirement as we grow older and require more care. Out-of-pocket costs for an average 65-year-old retiree on traditional Medicare are projected to almost triple from around $500 per month this year to nearly $1,500 in today’s dollars by age 95. These costs are averages per person and do not include most long-term care. Costs may be much higher if you have expensive prescriptions. Medicare surcharges may also apply depending on your annual income.

Include health care costs as a separate expense in your retirement plan, and to be conservative, assume a 6% annual growth rate for Medicare expenses.

You may want to assess your long-term care alternatives while you are healthy, which is when you're likely to have the most options.

5. Be well diversified and stay invested

During periods of extreme market declines, a natural emotional reaction can be to “take control” by selling out of the market and seeking safety in cash. Losses hurt more than gains feel good. However, this kind of evasive reaction not only locks in losses but often results in missing some of the best days that closely follow, which can be key to portfolio recovery. For example, the second worst-performing day of the S&P 500 in 2020, March 12, was immediately followed by the second-best day of the year.

Trying to time the markets is extremely difficult. Staying the course with a diversified long-term investment strategy is more likely to produce a better retirement outcome.

6. Minimize taxes to maximize retirement dollars

Source: J.P. Morgan Asset Management.

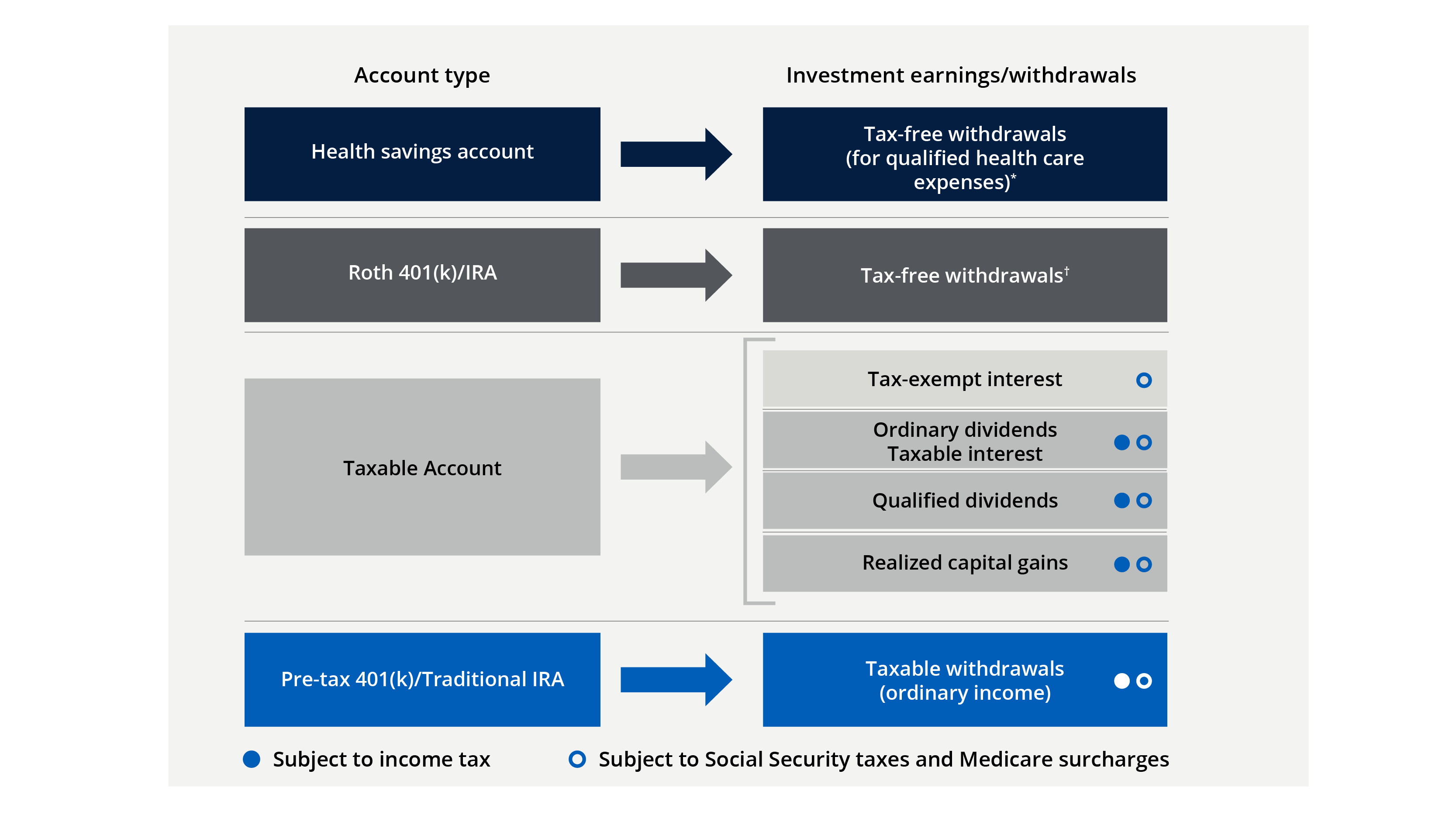

When creating a plan for your retirement savings accounts, consider the tax advantages of a diversified portfolio. Various types of accounts are taxed differently, and withdrawals can have an impact on how much you owe in income tax, Social Security income tax and Medicare surcharges. When building a retirement income plan, be aware of sources that may be used to determine:

- Income taxes

- How much Social Security benefit is subject to tax

- Additional required Medicare premiums

Currently, qualified withdrawals from health savings accounts (HSAs) and Roth accounts are tax-free and are not included in Social Security taxation or Medicare surcharge requirements. Roth accounts and HSAs can be nice complements to taxable and tax-deferred accounts because they can provide greater flexibility and control during retirement.

7. Maintain an emergency savings fund

Emergency savings are essential for building a resilient financial foundation. Life is uncertain. People encounter spending shocks due to unexpected expenses like inflation. They can also encounter income shocks from losing a job or experiencing fluctuations within a business.

Retirees encounter more frequent and dramatic spending shocks than workers, likely due to unpredictable costs such as health care. Lower-income households need more emergency savings because the shocks they encounter can be large relative to their baseline “normal” spending.

How much should you set aside in an emergency savings account? The amount will vary by household income, personal circumstances and comfort level. But as a general guide, consider setting aside two or three months of pay if you’re working or three to six months of income if you’re retired.

Start planning your retirement today

The best way to secure your future is to start planning early. As a business owner, solutions like the Everyday 401(k) can help you and your employees stay on track with your retirement goals. To learn more about your options, reach out to your Chase business banker or your Chase Wealth Advisor.

The content of this article has been adapted from the 2023 Guide to Retirement, produced by J.P. Morgan Asset Management and available for review at https://am.jpmorgan.com/us/en/asset-management/adv/insights/retirement-insights/guide-to-retirement/