Welcome to your new Chase for Business account

Start with these important steps to get your account up and running.

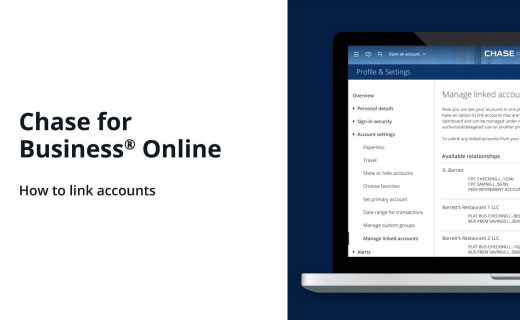

1. Sign in and link your accounts

Sign in to Chase for Business® Online

Manage all your Chase accounts with one online profile.

Link your accounts

This video shows you how to easily link your personal and new business accounts.

3. Add money to your Chase business account

It's important to add money to your new account within 60 days of opening. Use our Account Funding Hub to easily transfer funds.

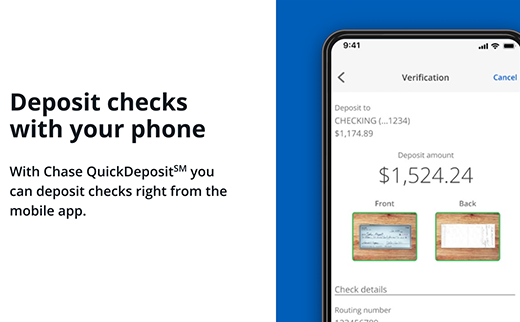

Deposit a check

An easy way is to use Chase QuickDeposit℠ right from your mobile app (limits apply), but you can also deposit a check at a Chase ATM or nearby branch.

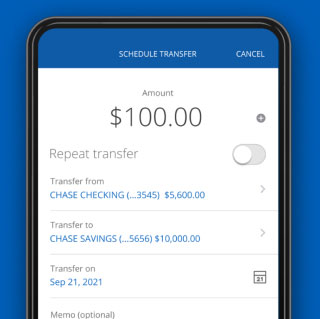

Transfer funds from another Chase account

Once you’ve signed in to your Chase online profile, you can easily move money between accounts. Watch this video to learn more.

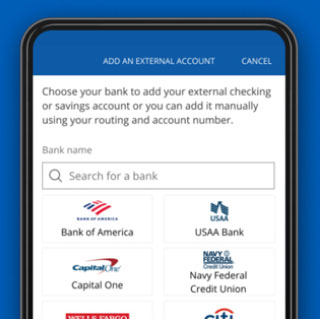

Add funds from a non-Chase bank account

You can also transfer money from an external account into your Chase business account. This video shows you how.

Explore other banking features

Get to know the different banking features we offer, designed to benefit your business.

Control access and security

Set up additional users and control who has access to your Chase business accounts.

Get paid

With our full suite of payment solutions, including QuickAccept℠, we’ve got your business and customer needs covered.

Pay bills

Compare options, choose what's right for your business and make digital payments directly from the Payment Center.

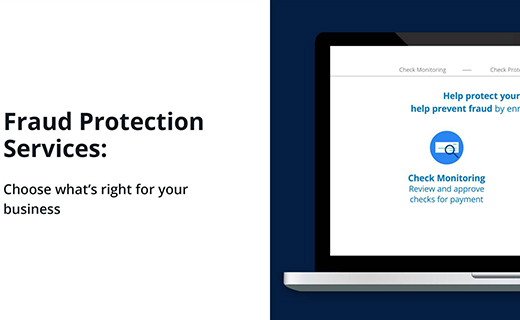

Monitor and protect

Learn about ways to help safeguard your account and enroll in our Fraud Protection Services.

Want to speak with a local banker?

Schedule a meeting now.

Chase business account FAQs

Here you’ll find answers to some common business account questions.

Control access and security

Enroll in Access & Security Manager.

Watch this video to learn how to grant account access to your most trusted employees:

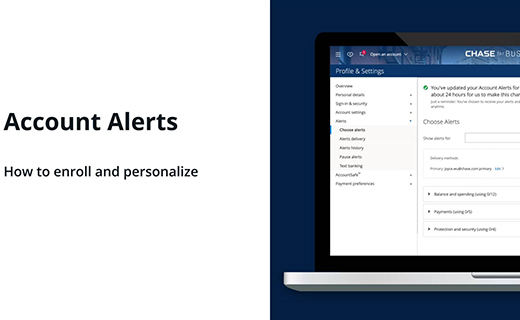

Follow these quick steps to set up alerts for your account:

- After signing in, choose the "Account management" tab

- Choose "Profile & settings," then choose "Alerts"

- Go to "Choose alerts" and pick the accounts you want

- Under "Delivery methods" customize options and choose "Save"

- You're now enrolled

Get paid

With a Chase Business Complete Checking℠, account, you can accept card payments when you use Chase QuickAccept.

Manage cash flow

With changing market conditions come challenges to maintaining the cash you need to operate. We’ve put together some great articles to help you better navigate your cash flow.

With our Business Cash Flow Tool, you can visualize annual inflows and outflows for business insights. You can even use it as a forecasting tool to run different scenarios.

Monitor and protect

Explore our seven tips for a more secure business online.

You can set up security alerts that will send you a notification based on set dollar amounts for different transactions.

More Chase business account FAQs

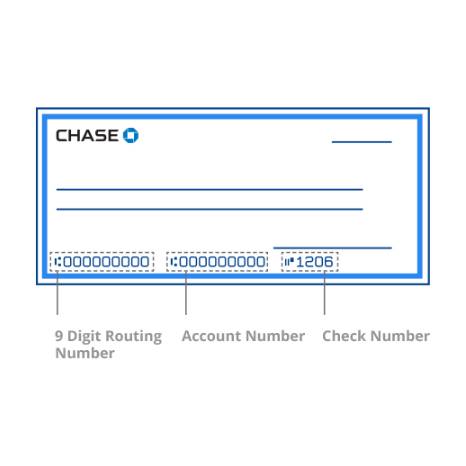

You can find them along the bottom of your checks

They can also be found by using the Chase Mobile app or by signing in to your account online.

- Sign in to chase.com

- Find your account and choose "More"

- Choose "Account & routing numbers"

You can find details on monthly service fees, ATM fees, overdraft fees and more by following the link below.

Select your account to learn more.

With Overdraft Protection, the exact amount needed to cover an overdraft will be transferred from your linked Chase business savings account or line of credit to your checking account if funds are available. You can enroll in Overdraft Protection at a Chase branch.

As a reminder, all Chase business accounts are automatically enrolled in Debit Card Coverage for everyday debit card transactions. With this coverage, we may pay the overdraft transaction at our discretion based on your account history, deposits you make and the transaction amount. If you don’t have Overdraft Protection, or you don’t have enough funds in your linked Overdraft Protection backup account, Standard Overdraft Practice fees apply. To unenroll in Debit Card Coverage, call 1-800-935-9935 or go to a Chase branch.

Your new card should arrive in 3-5 business days after opening your account. You can also order replacement and employee cards by following the instructions online.

You can order checks on the Deluxe website or by calling 1-888-560-3939. Make sure you know your routing/transit and account numbers. You can also order checks by going into a local Chase branch. Use our branch locator to find one near you.

Switch your external business account over to Chase

Once you’ve added funds to your Chase business checking account within the first 60 days of opening your account, you’ll need to switch your payments and deposits. Learn how to complete the process by clicking the button below.

Check out more Helpful Tips videos

Our Helpful Tips video library is an excellent resource for information and step-by-step instructions on how to use a variety of Chase products and services.

Alerts: Enroll and choose alerts

Get notifications to help monitor your account

Fraud Protection Services: Overview

Choose the right service for your business

Chase QuickDeposit℠

Deposit checks with your mobile device