Take control of your credit score

A personalized plan can help you take charge of your credit. Just complete a few simple steps, and you’ll be on your way to help improve your score.

Step 1

Choose a time frame.

Step 2

Compare action plans.

Step 3

Set your goal.

Set a score improvement plan. See the difference.

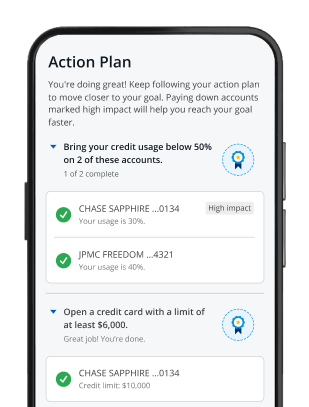

Credit Journey's score planning tool, uses your credit report to calculate a score you could achieve by following the detailed steps in your personalized score improvement plan provided by Experian™. You will be able to:

- Track your progress

- Get a summary of your results

- Set a new goal once your plan ends to keep building your score

Tip: Using Credit Journey won’t hurt your credit score, and it’s 100% free.

Benefits of a higher credit score

A higher credit score may let lenders know you’re financially responsible. So having a good score could mean you’ll have a better chance of getting a lower interest rate and, in turn, lower monthly payments, when you’re ready to buy a car, home or apply for a loan.