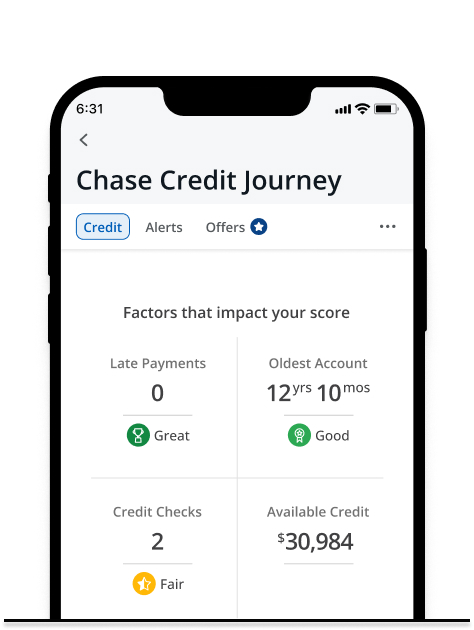

Your score doesn’t have to be a mystery

Credit Journey makes it easier for you to understand your credit score and why your score changed. Get better insight into what factors affect your score.

Get alerts if your credit changes

All of your accounts are monitored —not just Chase accounts—and you will be alerted when changes in your credit report occur.

Credit usage and limits

Get informed when the credit usage or credit limit on any of your accounts has changed.

Account status

Get notified you if you have a past-due balance or if you’ve paid off an account.

Credit checks

Get alerts you when your credit is checked or a new account has been opened in your name.

FAQs

When you enroll in Chase Credit Journey® , you can check your free VantageScore® 3.0 credit score, based on your Experian™ credit report, as often as you’d like with no impact to your credit. You can also receive your credit report directly from the three credit bureaus (Experian, TransUnion® and Equifax®) at no cost once a year.

Credit monitoring involves keeping track of your accounts and any changes in your credit report that could impact your score. This monitoring helps to identify potential fraud as well as shifts in creditworthiness.

With Credit Journey, we regularly check your credit report and will let you know if we see changes on your Chase or other accounts.

Many credit card issuers provide their card members with free credit score monitoring. Chase offers credit monitoring through Chase Credit Journey for all of your accounts, not just Chase accounts..

In addition to receiving a credit score, you can monitor your credit by keeping track of your credit reports and reviewing your bills, purchases and cash advances. Be sure to review your statement for any suspicious transactions. You may want to consider using a credit monitoring service—such as the one offered by Chase Credit Journey—which will alert you of changes on your credit report