INVESTING GOALS529 plans help put education within reach

Invest in a 529 plan with one of our advisors and get no upfront fees, so more of your money goes towards reaching your goals.

Call 1-833-542-2474 to speak to a J.P. Morgan team member Monday–Friday from 8 AM to 9 PM ET and Saturday from 9 AM to 5 PM ET. Or fill out a form and we’ll contact you.

Learn more about 529 plans

What is a 529 plan?

A tax-advantaged investment account to help plan for qualified education expenses and more.

Who is a 529 plan for?

Anyone looking to invest for future education needs.

Why choose a 529 plan?

To meet the future costs of education, while benefiting from tax-free investment growth and the power of long-term compounding.

Why invest in a 529 plan with J.P. Morgan?

Experience no upfront sales charges

When you open a 529 plan with one of our advisors, you won’t receive upfront sales charges, so your money goes further towards your education goals.

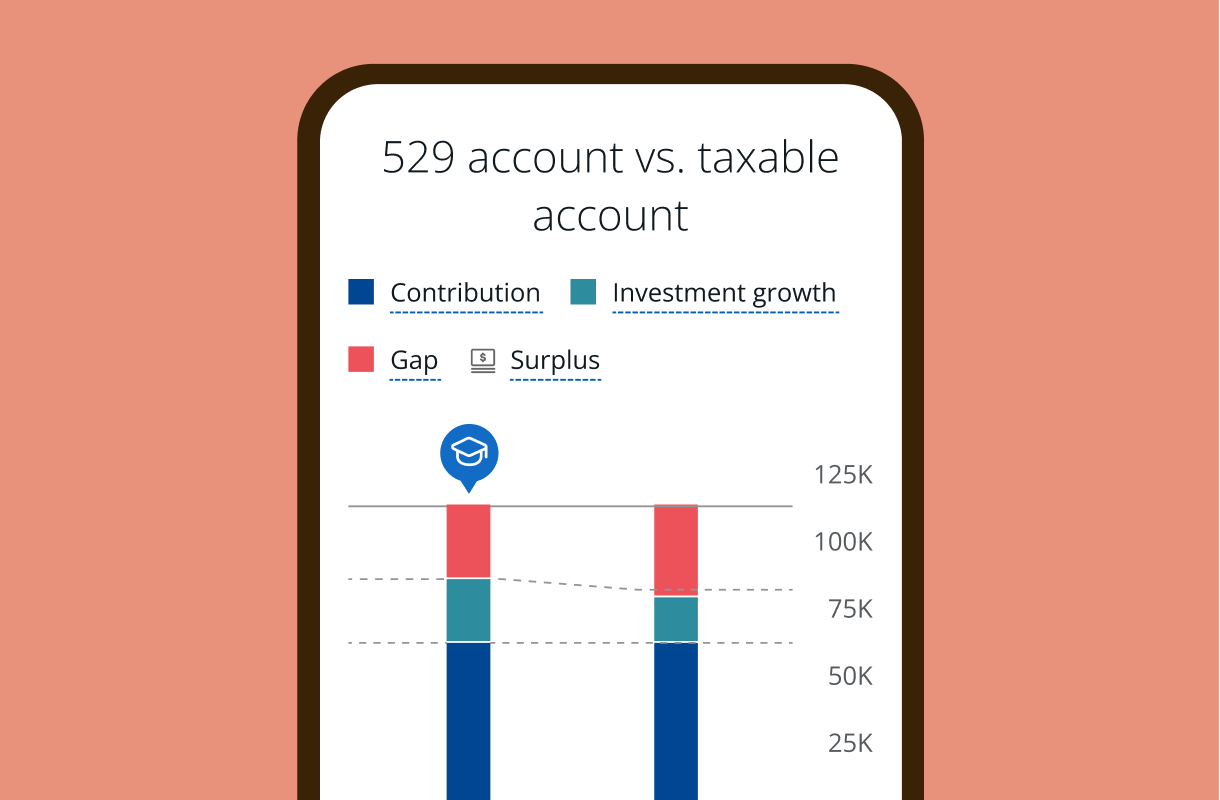

Grow your 529 investments tax-free

529 investment growth is tax-free, so even while your investments may grow, you won’t have to pay taxes when used for qualified education expenses. Many states also offer additional benefits such as income tax deductions for their residents who invest in in-state plans.

Enjoy more flexibility

There are no income limits on contributors or age restrictions on beneficiaries—unlike other accounts typically used for education including custodial (UGMA/UTMA) or Coverdell Education Savings Accounts.

Contribute more tax-free gifts, faster

Make five years’ worth of tax-free gifts in a single year. As of January 1, 2025, individuals can contribute $95,000 per beneficiary, while married couples filing jointly can contribute up to $190,000.

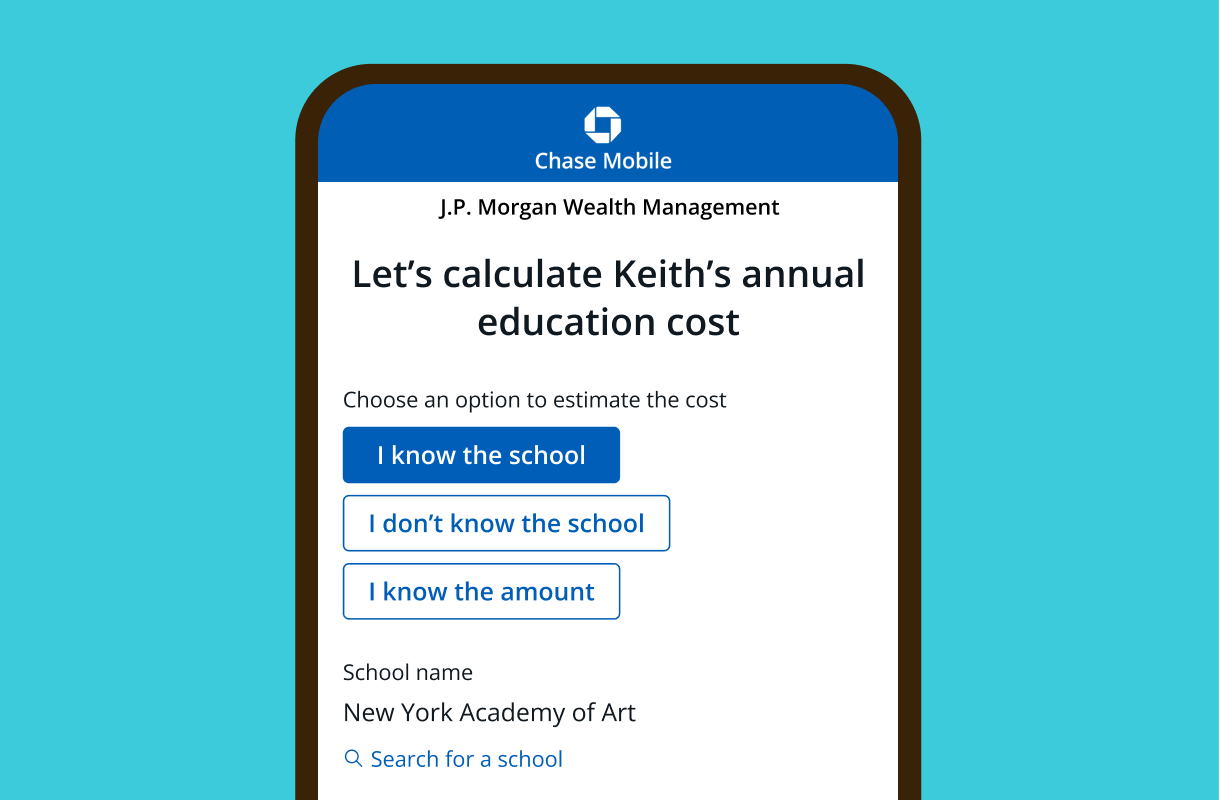

Streamline your education planning with Wealth Plan

J.P. Morgan Wealth Plan® is our award-winning digital money coach that makes it easy to set and track your education goals and offers insights to guide you, every step of the way.

IMPORTANT: The projections or other information generated by Wealth Plan regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Get started with a 529 Plan today

Call 1-833-542-2474 to speak to a J.P. Morgan team member from Monday–Friday from 8 AM to 9 PM ET and Saturday from 9 AM to 5 PM ET. Or fill out a form and we’ll contact you.

Frequently asked questions

It all begins with opening a 529 account. Whether you’re a grandparent, parent, or other family member you may be able to start a 529 investment account for a child in your life (or even yourself) and start making contributions right away.

529 funds can be used for educational costs — the most common being higher education, including graduate school and many of its associated expenses. Funds from a 529 plan can also be applied to K-12 tuition, vocational school and registered apprenticeships.

The maximum 529 contribution limits vary by state, but there are no minimum requirements. While 529s are subject to gifting rules, a unique feature is that they allow five years of a tax-free gift in a single year. As of January 1, 2025, individuals can contribute $95,000 per beneficiary, while married couples filing jointly can contribute up to $190,000.

When assets held in a 529 account grow, the assets are tax deferred until withdrawal and are not taxed upon withdrawal if they are used for qualified education expenses. However, unqualified withdrawals are subject to taxes and penalties on the investment gains. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

Yes, a 529 plan is considered an asset for the purposes of calculating financial aid. However, a family's annual income — including the student's — counts for significantly more in the Expected Family Contribution (EFC) financial aid formula than savings and investments, especially if held in the parents' names.

Additionally, college costs continue to rise while financial aid has been relatively flat leaving families to cover more of the expenses. Starting and building a 529 investment plan with the benefit of compounding over time can help put you in control of education expenses.

529 plans may charge a program management fee and/or a state administration fee, in addition to the expense ratios of the underlying mutual funds. Many plans charge an annual account maintenance fee, although such plans often reduce or eliminate this fee for in-state residents, clients who make automatic contributions or for accounts above a minimum balance. Certain 529 plans waive the front-end sales charge/load fee (no upfront fee) on Class A shares to J.P. Morgan Wealth Management clients with no additional qualification criteria; 12b-1 (“trail”) fees continue to apply.

Sharpen your knowledge

How to save for college during market volatility

See a full picture of your savings, spending, financial goals and external accounts—all in one dashboard.

By Michael Conrath | 3 minute read

529s: All the latest insights

It’s never too late to start putting money into a 529 plan to send loved ones to college. Find out all the latest insights, and what fees to understand.

By Kate Gillan

What to keep in mind when choosing a 529 plan

These tax-advantaged education investment accounts can be a useful way to put away your money for education.

1 minute read