EDUCATION GUIDES It’s always a good time to save for education

Use our guides for tips on how to create a education investment plan and help teach your children how to be financially responsible while in college and post graduation.

Getting started

Three ways to grow, manage and fund education savings.

01 Consider tax-advantaged funding

A J.P. Morgan advisor can help you understand how a 529 plan or another type of tax-advantaged investment account can help you on your journey.

02 Discuss finances

Your child’s relationship with money is influenced by your own. Financial transparency and establishing healthy habits early can make all the difference.

03 Borrow responsibly

If your child takes out a student loan, make sure you both understand what’s involved. Learn about repayment expectations and be realistic about their ability to repay.

What you need to know about saving for college

Teaching your kids about money management

Investing might seem like a topic that’s too complex to talk about with kids, but there are ways to broach the topic at every age. Keep reading to learn how.

College knowledge: Debunking 529 plan myths

It’s important to debunk common myths that can cause parents, grandparents, aunts and uncles to miss out on the potential tax savings and college planning benefits.

What are my options to save for my child’s education?

Planning early for your children’s and grandchildren’s education can help you cover these expenses in a tax-efficient manner.

Learn about your funding options

Did you know there are ways to save designed for qualified education expenses?

What it is

A tax-advantaged investment product for education that has a low impact on financial-aid eligibility.

Benefits

- Many state plans offer a state income tax deduction for contributions made by in-state residents.

- It may be applied to K-12 tuition (up to $10,000 per year), vocational school, registered apprenticeships, college, graduate school and student loans (up to $10,000 in total).

- Investments grow tax-deferred.

- Withdrawals are not subject to federal tax (when used for qualified education expenses)

- You can “front-load” your contributions by making five years’ worth of gifts in a single year.

- Easy to establish and maintain.

- Beginning in 2024, a 529 plan beneficiary can roll over up to a lifetime maximum of $35,000 in 529 plan funds into their own Roth IRA (subject to Roth contribution limits but not subject to income limitations) without paying taxes or penalties. The 529 plan must have been open for a minimum of 15 years and the assets being rolled into a Roth IRA must have been in the 529 for at least 5 years.

Disadvantages

- You're limited to the investment options offered by the 529 plan.

- Using annual exclusion gifts to fund a 529 account precludes use of the annual exclusion amount for other purposes.

- Some states don’t recognize certain expenses (primarily K-12 tuition) as qualified; withdrawals for those expenses may incur state income tax.

Schedule a meeting with your J.P. Morgan Private Client Advisor to open a 529 plan today. If you don’t have an advisor, fill out a form to set up a free one-on-one consultation.

What it is

A tax-advantaged investment product for education that has a low impact on financial aid eligibility.

Benefits

- Earnings accrue free of income tax.

- Distributions may be made free of income tax as long as they're made for qualified education expenses.

- Assets may be used to purchase many different types of investments, including stocks, bonds and mutual funds.

- Easy to establish and maintain.

Disadvantages

- The maximum contribution is limited to $2,000 per year, per beneficiary. The $2,000 contribution maximum is gradually phased out if your modified adjusted gross income falls between $190,000 and $220,000 ($95,000 and $110,000 for single filers).

- Contributions must be made before the beneficiary reaches age 18.

What it is

Types of custodial accounts that can be used for a child's general benefit, not only for education.

Benefits

- The custodian controls the account and can invest the account’s assets in any manner they choose.

- The custodian can choose whether or not to use custodial assets to pay for the minor’s expenses.

- Most states now use UTMA rather than UGMA. South Carolina is the only state that doesn’t offer UTMA accounts, although you can still open a custodial account under the South Carolina UGMA.

Disadvantages

- Custodial accounts are considered assets of the minor and must be turned over to them when they reach the age of majority (usually either 18 or 21 depending on your state of residence).

- Since they are the minor’s assets, custodial accounts could potentially limit financial aid eligibility.

- Using annual exclusion gifts to fund an UTMA or UGMA account may prevent the use of the exclusion for other purposes.

- Income from these accounts is typically taxed at the same rate as the parents.

What it is

There are various financial aid packages, from scholarships to federal student loans, which you’ll most likely need to renew annually. These options can be used to supplement your education savings.

Benefits

- Often, grants and scholarships don't have to be paid back.

- Federal student loans are easy to apply for and offer flexibility when it comes to repayment.

- Student loan interest can be tax-deductible.

Disadvantages

- Merit-based scholarships can be very competitive and not everyone qualifies.

- Only 0.3% of students receive enough free aid to completely cover their education.

- 32% of financial aid is disbursed through federal loans that need to be paid back with interest.

- Today, a record 4 in 10 households owe student loan debt.

- It is generally more difficult to discharge student loan debt than other forms of debt, even in bankruptcy.

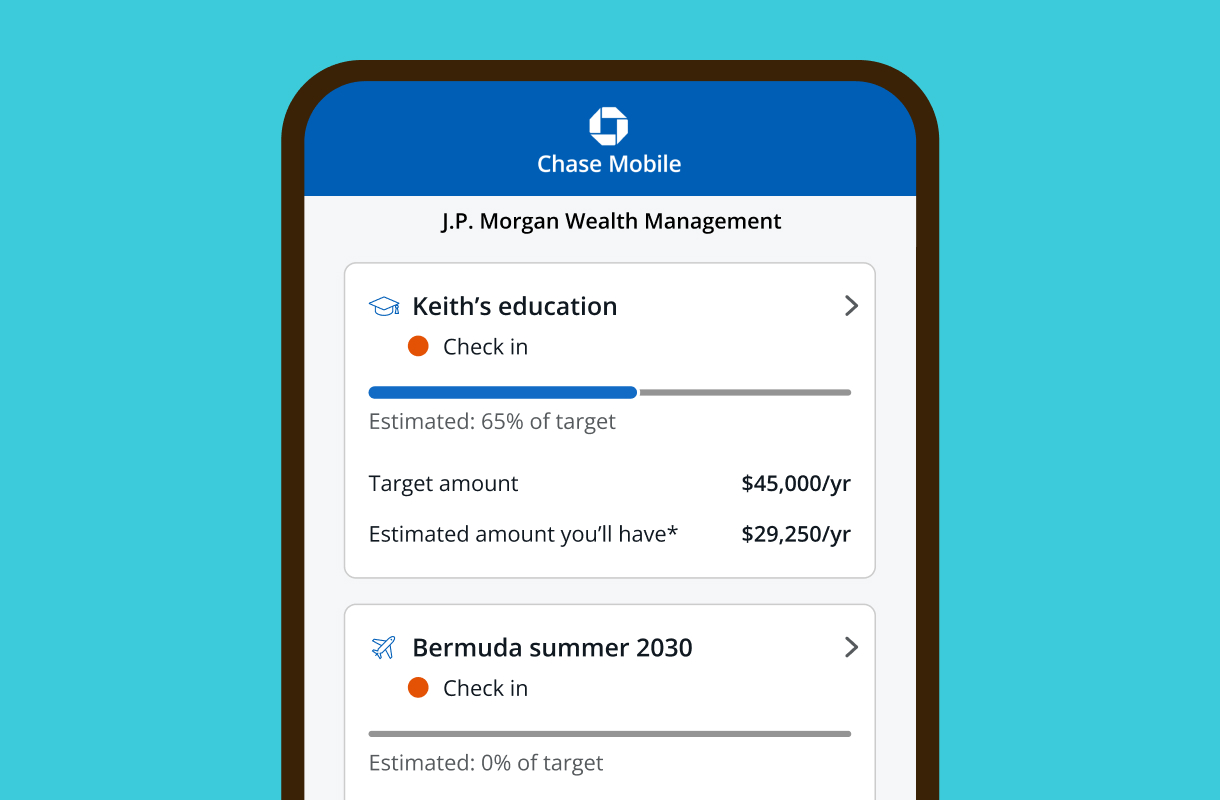

Tools to help you plan your education funding

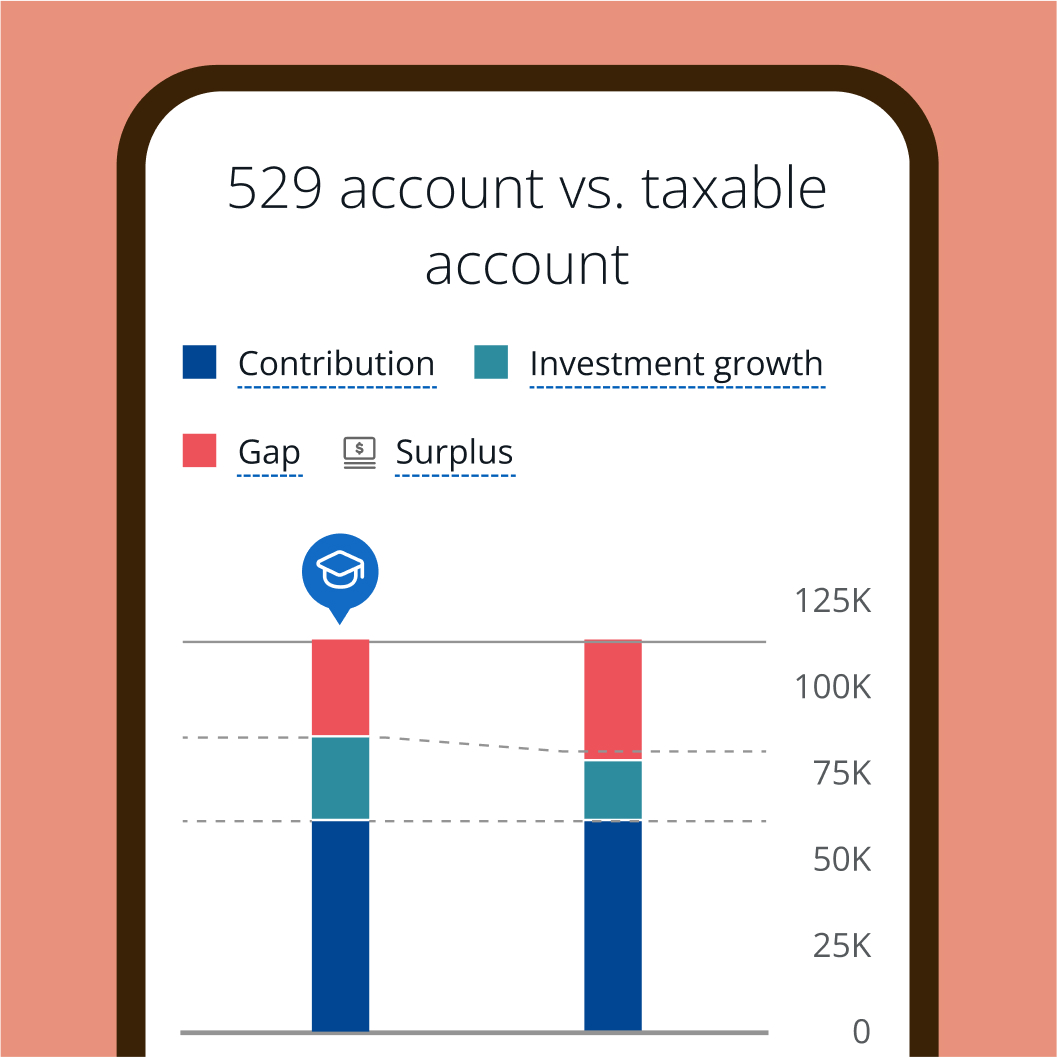

Reach your education goals with a 529 plan

Already have a Private Client Advisor?

Meet with your advisor to open a 529 plan and learn how it can impact your education investment strategy.

Interested in working with an advisor?

Partner one-on-one with a J.P. Morgan Private Client Advisor to start investing in a tax-advantaged 529 plan for a child in your life.

Here’s how we can work together

Whatever your investment goals are—saving for education, retirement or buying a home—we offer a range of services to support you as your financial needs evolve over time.

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.