Help grow your wealth with a brokerage account

Conveniently invest in stocks, ETFs and mutual funds with brokerage fees starting at $0.

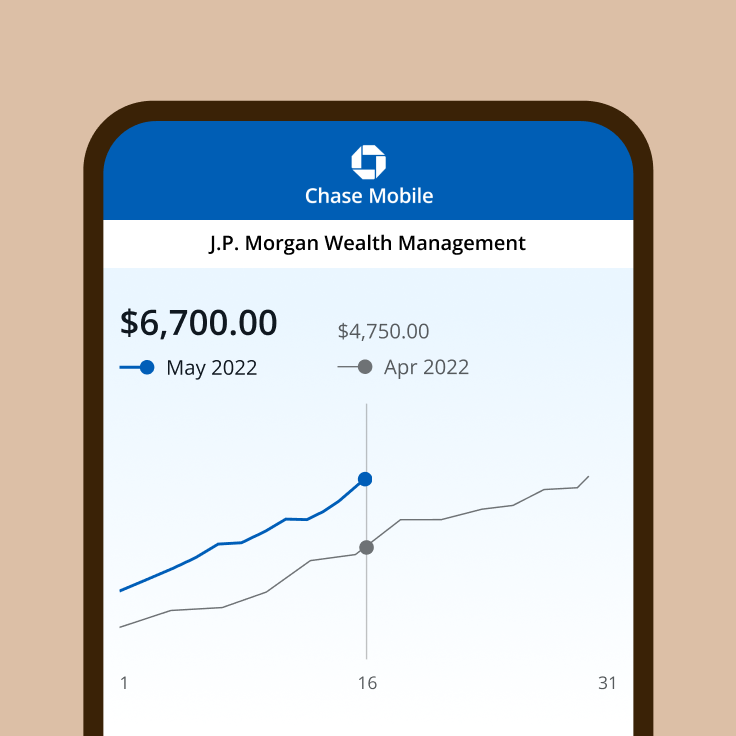

Already have a J.P. Morgan account? Keep an eye on your investments and review your portfolio to help you reach your goals.

Learn more about brokerage accounts

What is a brokerage account?

An investment account that enables you to buy and sell securities like stocks, ETFs, mutual funds, bonds, options and more.

Who is a brokerage account for?

Anyone who wants to invest in securities either in a general brokerage account or with an advisor to reach their goals and build their wealth over time.

Why open a brokerage account?

To have access to markets, investment research and tools to grow your wealth, on top of traditional savings and retirement accounts.

Discover our investment products

Stocks

Invest in publicly traded companies and start customizing your investment portfolio today.

ETFs

Structured like mutual funds but traded like stocks, exchange-traded funds (ETFs) can provide market flexibility.

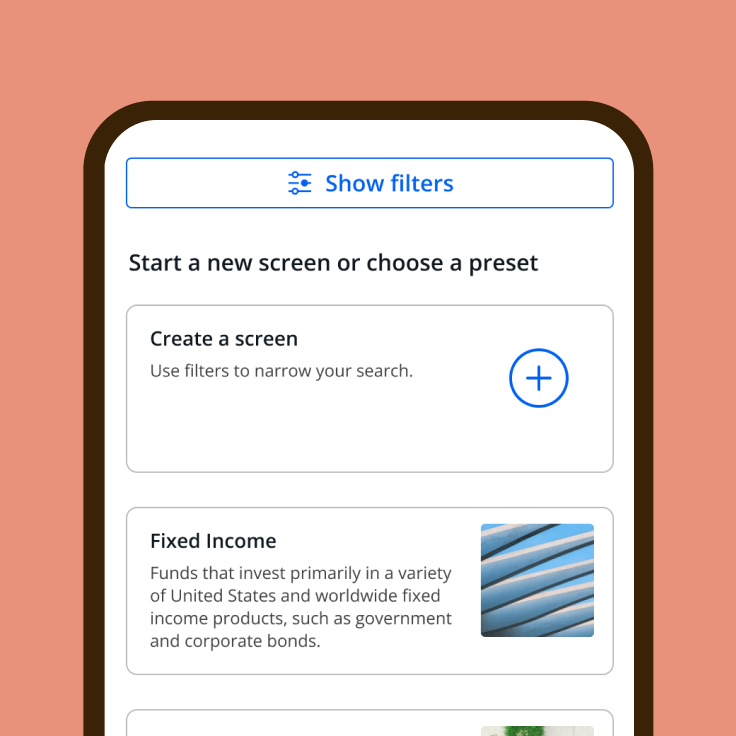

Mutual Funds

A professionally managed portfolio of investments such as stocks, bonds and other assets.

Open a brokerage account with J.P. Morgan Wealth Management

- Access thousands of investments including stocks, ETFs, mutual funds and options.

- Save money with $0 commission online trades so you keep more of your investment.

- Tap into J.P. Morgan Research for help adapting to changes in the markets and in your life.

- Securely access all of your J.P. Morgan investment and Chase banking accounts anywhere, anytime in Chase Mobile® app or at chase.com.

Here’s how we can work together

INVEST ON YOUR OWN J.P. Morgan

Self-Directed Investing

Build your investment portfolio on your own with unlimited $0 commission online trades.

INVEST ON YOUR OWN J.P. Morgan

Self-Directed Investing

Build your investment portfolio on your own with unlimited $0 commission online trades.

WORK ONE-ON-ONE WITH AN ADVISORJ.P. Morgan

Private Client Advisor

Work 1:1 with a dedicated advisor in your local community to create a personalized financial strategy and build a custom investment portfolio.

WORK ONE-ON-ONE WITH AN ADVISORJ.P. Morgan

Private Client Advisor

Work 1:1 with a dedicated advisor in your local community to create a personalized financial strategy and build a custom investment portfolio.

Frequently asked questions

An individual brokerage account is a type of financial account that enables you to buy and sell securities like stocks, ETFs, mutual funds and options using your own, personal investment account. An individual brokerage account is separate and distinct from savings, checking, IRA or 401(k) accounts.

A brokerage account is a taxable account that allows you to take action on your investment strategy, trading stocks, bonds, funds or other securities, helping you grow your wealth and meet your long-term goals.

Sharpen your knowledge

What is a brokerage account?

Brokerage accounts allow investors to buy and sell securities, but unlike retirement accounts, investment income from brokerage accounts is generally taxable.

When should I sell stocks?

There are instances where selling a stock might make sense. Learn more about how to spot them here.

Break it down: How to Avoid Cash Trading Violations

When you start trading, be careful to stay on the right side of these brokerage rules.