The basics of a Roth IRA account

What is a Roth IRA?

A Roth IRA is an individual retirement account in which your contributions are not tax-deductible. Your earnings, if any, are tax-deferred and may be withdrawn tax-free if certain conditions are met.

Who is a Roth IRA account for?

Anyone with taxable compensation who wants to save for retirement on a potentially tax-free basis can open a Roth IRA account. You cannot deduct contributions from a Roth IRA and they may be limited based on your income tax filing status and modified adjusted gross income (“MAGI”).

Why invest in a Roth IRA?

Contributing to a Roth IRA account is a way to save for retirement that may provide a tax advantage upon withdrawal. Contributions are made with after-tax dollars (and are never deductible), but “qualified distributions” aren't subject to federal tax upon withdrawal. Learn more.

Benefits of a Roth IRA account with J.P. Morgan

Holistic view

Consolidate your eligible 401(k) or other retirement accounts and keep track of your investments—in the Chase Mobile® app or at chase.com.

Personalized advice

Work with our J.P. Morgan advisors to help design a retirement strategy based on what’s important to you.

Powerful tools

Use J.P. Morgan Wealth Plan® to set and track your retirement goals, and get personalized insights to guide you on your journey.

Thousands of investments

Once you open the right IRA account for your needs, you can choose from a wide range of stocks, ETFs, fixed income, mutual funds and options.

Start your investment journey

Get started with a J.P. Morgan Roth IRA account. You can open one on your own or you can work with our advisors.

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

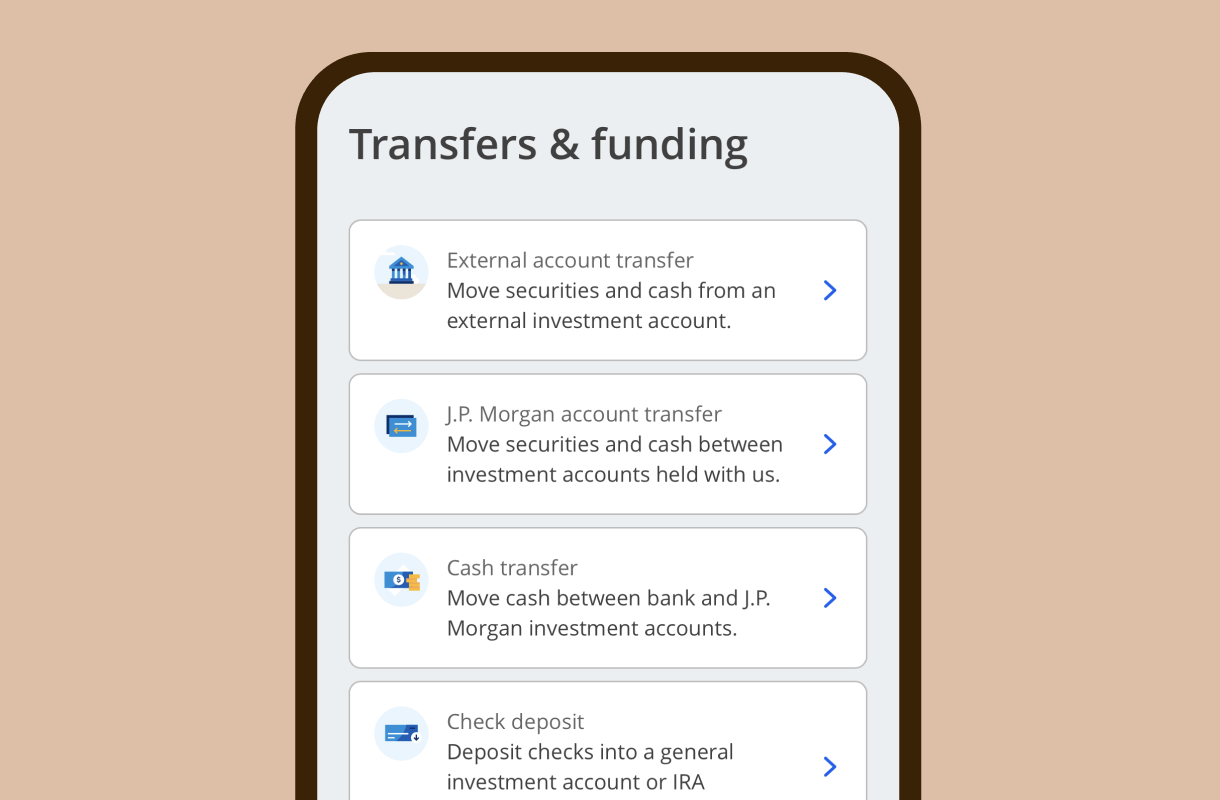

Looking to consolidate? Roll over or transfer external accounts

Keep your retirement savings in one place by rolling over your 401(k) and other employer-sponsored retirement accounts or transferring external IRAs to a J.P. Morgan IRA.

Stay on track with our retirement tools

Is a Roth conversion right for you?

Use our calculator to see the potential future value of your Traditional IRA in comparison to a Roth IRA.

Retirement calculators

From 401(k) planners to IRA calculators, our calculators can help you run the numbers, compare tax implications and much more.

Already have a Roth IRA account with J.P. Morgan?

Make a contribution

Make a one-time contribution or set up recurring transfers—from your Chase checking or savings accounts into your IRA.

Track your portfolio’s performance

Track and compare your portfolio’s performance relative to major indices, including the Consumer Price Index to measure against inflation.

Frequently asked questions

A Roth IRA is a retirement account where you may be able to contribute after-tax dollars and you don’t have to pay federal tax on “qualified distributions” (as defined by the IRS). You cannot deduct contributions to a Roth IRA

You can contribute at any age if you (or your spouse, if filing jointly) have taxable compensation and your modified adjusted gross income is below certain amounts.

The IRS sets annual contribution limits for Roth IRAs and Traditional IRAs. For 2024, the annual maximum is $7,000 if you are under the age of 50, or $8,000 if you are 50 or above. However, your Roth IRA contributions may be limited based on your income tax filing status and modified adjusted gross income. Learn more.

You may withdraw from a Roth IRA at any time; however, earnings that you withdraw may be subject to taxes if they do not meet the IRS definition of a “qualified distribution,” and if you are under age 59 ½ you may have to pay an additional 10% tax for early withdrawal unless you qualify for an exception. On the other hand, you don’t have to pay federal tax on any “qualified distributions.” Note there are no required minimum distributions (RMDs) with a Roth IRA if you are the original owner.

A rollover IRA is an IRA that is set up to accept assets from an employer-sponsored plan like a 401(k) or 403(b) once you have a qualifying distributable event (such as changing employers or retiring). The rollover IRA could be either a Traditional or Roth IRA depending on the circumstances.

Traditional and Roth IRAs both offer a way to save for retirement that give you tax advantages.

A Traditional IRA is an individual retirement account where your contributions may be tax-deductible, and you pay taxes when you withdraw your money. Potential earnings grow tax-deferred until withdrawal. Traditional IRAs are subject to the IRS’ required minimum distribution (RMD) rules. For individuals age 73 and older who have a Traditional IRA, RMDs must begin by April 1 of the year following the year you turn 73 and must be taken by December 31 of each year after the year you turn age 73.

A Roth IRA is an individual retirement account where you contribute after-tax dollars, and you don’t have to pay federal tax on “qualified distributions” including potential earnings, if certain criteria are met. Roth IRAs of original account owners are not subject to the IRS’ RMD rules. Learn more (PDF) about their key differences and how each of these IRAs may meet your needs.

To convert a Traditional 401(k) to a Roth IRA, you’ll need to roll over your 401(k) to a Traditional IRA first, then convert it to a Roth.

To convert your J.P. Morgan Traditional IRA to a J.P. Morgan Roth IRA:

- Go to our Brokerage Forms page and choose the "Roth IRA Conversion Request" form.

- Complete the form and send it to the address provided. There are eligibility requirements for a Roth IRA so make sure you speak to your tax professional.

If you need help, you can call us at 1-833-829-6472, Monday-Friday from 8 AM to 9 PM and Saturday from 9 AM to 5 PM ET. If you have a managed retirement account, please work directly with your J.P. Morgan advisor to convert your account.

You can easily open a Roth IRA online or with a J.P. Morgan advisor. Once you fill out an application and are approved, you’re ready to start making contributions (if eligible) and investing in mutual funds, bonds, stocks and exchange-traded funds (ETFs).