Trade funds with ETFs in real time

Structured like mutual funds but traded like stocks, exchange-traded funds (ETFs) can provide market flexibility.

Already have a J.P. Morgan account? Keep an eye on your investments and review your portfolio to help you reach your goals.

Discover ETFs

What is an ETF?

A type of security that tracks an index, sector, commodity or other asset. Trading ETFs is a convenient way to grow and diversify your portfolio, with the same flexibility as buying and selling stocks.

How do ETFs work?

ETFs are traded like stocks on the market. They hold a collection of stocks, bonds or other securities in one fund or have exposure to a single stock or bond through a single-security ETF.

Why invest in ETFs?

They include various types of investments like stocks and can provide additional tax and liquidity benefits.

Investing in ETFs with J.P. Morgan

- Diversify your investment portfolio quickly, easily and conveniently.

- Buy and sell funds on an exchange in real time and get liquidity when you need it.

- Meet your goals with passively-managed ETFs, which can provide tax-efficient options and diversification at low fees.

- Take advantage of the flexible, broad trading options provided by the liquidity of an ETF, which is based on the securities it holds and its trading value.

Here’s how we can work together

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Already a J.P. Morgan Wealth Management client?

Fund your account

Move cash instantly from a Chase checking or savings account to your J.P. Morgan Wealth Management account—as often as you want.

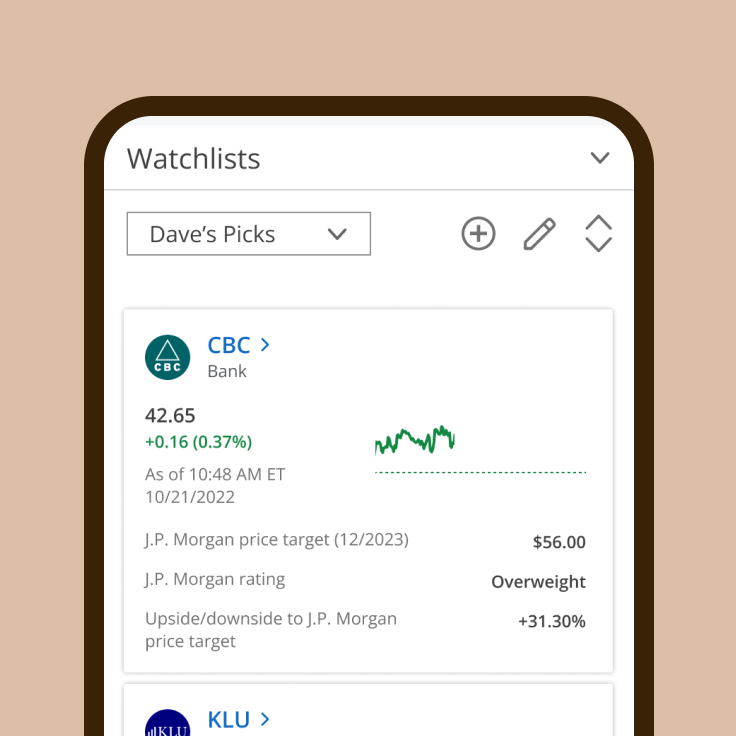

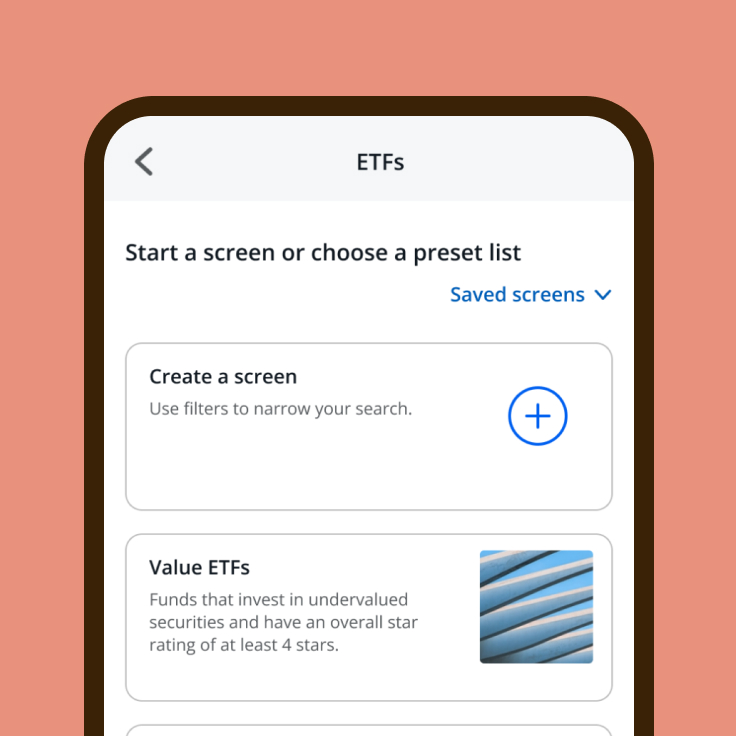

Find ETFs

Use our screeners to help you find the ETFs that fit in your investment strategy. You can easily add them to your portfolio right in the Chase Mobile® app or at chase.com.

Learn more about our other investment products and accounts

Frequently asked questions

An exchange-traded fund (ETF) is a basket of securities that trades on an exchange just like a stock does. ETfs often track the performance of an underlying market index, such as the S&P 500, by holding a collection of stocks, bonds, or other securities in one fund.

ETFs track the performance of an underlying market index, such as the S&P 500. Investors don't own individual stocks. They hold a collection of stocks, bonds or other securities in one fund or have exposure to a single stock or bond through a single-security ETF. Instead, ETFs provide them with the opportunity to buy and sell shares of the ETF on an exchange and to benefit from potential market performance.

You can open a brokerage account with J.P. Morgan's Self-Directed Investing tool. If you prefer a more personalized experience, you can work directly with a J.P. Morgan Advisor to go over your investment options. Get started here.

ETFs have fees but they tend to cost less than those associated with mutual funds. The two most common costs associated with ETFs are the expense ratio, the fee that goes to the fund and the brokerage fee, a flat cost per trade that goes to the financial institution. J.P. Morgan offers unlimited commission-free trades and ETFs do not require a brokerage fee.

ETFs tend to be more tax-efficient than mutual funds. For example, if you compare an ETF and a mutual fund in the technology sector, the ETF is generally more tax-efficient. Meet with a J.P. Morgan Advisor who will answer your questions about your investment strategy and speak to you tax professional about your tax situation.

Sharpen your knowledge

What's inside an ETF?

You may wonder how exchange-traded funds (ETFs) differ from one another. Here's what you see if you cut open an ETF.

What is an inverse ETF?

Inverse ETFs allow investors to profit from market declines but are fraught with risk, as rebalancing and compounding can skew performance. Learn more about them.

Break it down: Exchange Traded Funds (ETFs)

What's an ETF? We explain how these funds work.